Uniper was a gift that was handed out to me from E.On. The initial idea from E.On was to make one purely green utility company (under the name of E.On) and one less green company under the name of Uniper. Great idea but poor execution that was stopped my various German governmental bodies which means that E.On still had to hold on to nuclear power stations.

Since the Fortum sold off their power grid in for instance Sweden (idiots in my opinion) they have been searching for new places to put this money and the market have apparently suspected one of those locations to be Uniper. Fortum and E.On have recently announced the take over. Due to my take over experience with K+S that I utterly failed to respond correctly to I decided to pretty much always step out of a company if there is an offer and the share price on the market is pretty much close to that offer. Hence, I stepped out of Uniper.

I therefore sold all my 40 shares in Uniper and I received a total of 875.10 € paid out on my broker account which means, since they were handed out to me from E.On at 10 € per share, that I made a profit of 475.10 € which is the equivalent of 119% profit and additionally I have received 22 € in dividends. Since this was a gift from E.On I consider my holding time to have been 67 months.

To find out more about Uniper please click here.

Enel is by far my best utility company investment. Very early on I was annoyed that I had managed to buy more before the share price started to increase and all I had was an initial investment of 1077 € for the 450 shares that I bought back in 2013 for 2.38 € per share.

The wonderful thing with Enel is that they are the most green utility company that I have had which would be excellent also moving forward in the future but there is a price boarder on everything and Enel have lately gone past that. When a utility company is trading up at a P/E above 20 WITH excellent earnings then for me it is a very clear signal to walk away and that is exactly what I did.

When I sold my shares the price was up at 5.125 € and I received 1220.38 € out in cash as profit. This means that I made a profit of 113% during my 51 months of holding and on top of that I have received 274.5 € in dividends.

To find out more about Enel and to follow the journey then please click here.

My average holding time on my sold investments are now up at 36 months which I find fully acceptable.

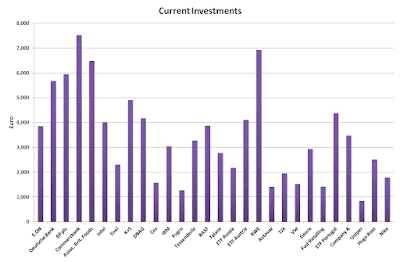

Any changes will be brought into the stock portfolio upon the next update in the very end of the month.