It took some time but now I have finally managed to get the list up and running with the Google Docs / Drive and I have it open for everyone to see and follow. The update in the share price will be made every 20 minutes or so and I will (hopefully) once per month take a snapshot of the stocks and post that in the

Stocks of Interest page. There you can also find the permanent link to the Google spread sheet. Unfortunately the list does not sort itself automatically with changing share price but I will try to do also that once per month.

As always some analysis of the companies can be old meaning that it is not based on the previous annual report. If you want the corrected information then please just poke me so that I can make the fresh analysis of the company and so that I can change the data in the spread sheet.

In the spread sheet there are also links going to the last analysis that was made of the companies so by simply clicking on those links you will find out a bit more about the company and you also get direct access to the link to their home page to be able to make your own investigation of it and to get a feeling for a potential moat of the company.

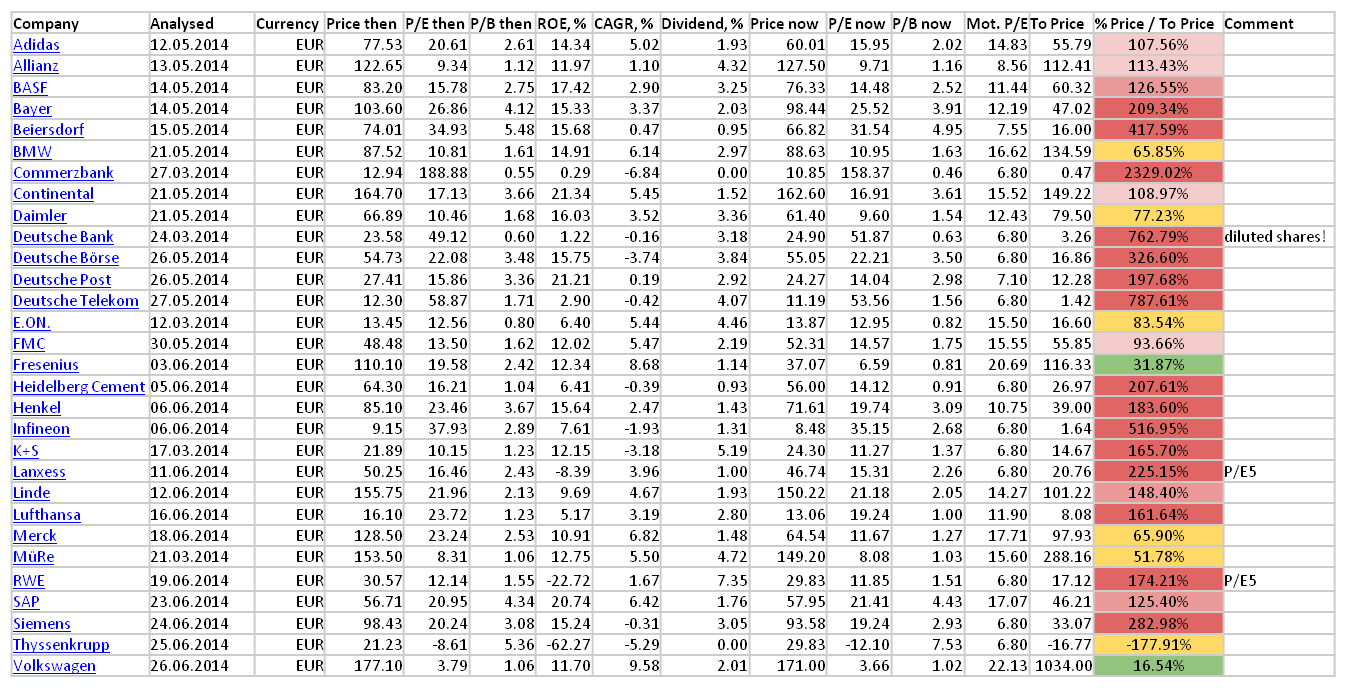

Here is the snapshot of the current list:

Several companies have been kicked out from the

Stocks of Interest list and I will over time build another spread sheet with those. For the moment they are simply out and I am sorry about this but they will soon be brought back on another list so that they can still be followed and the principle there is also that each analysed company that were kicked out should be brought to that new spread sheet.

I will also create a list with the 30 DAX companies that can be accessed also on the

Stocks of Interest page but I will again make a post to inform when that has been done so that you can follow them with live updates of their figures based on the previous annual report.

I must of course also put in my own shares in a list with this live update and I am currently working also on this and that will then be accessed on the

Stock Portfolio page but without the snapshots since I there use a different approach of publishing the development.

If you have any suggestions and ideas on what else I should implement or changes to what I have and will implement then please just let me know!