Company: Talanx

ISIN DE000TLX1005 | WKN TLX100

Business: A German mutual holding insurance company. It is divided into five divisions: Industrial Lines (covering all the insurance needs of industrial companies), Retail Germany (retail and commercial customers covering property/casualty), Retail International (outside of Germany), Reinsurance (non-life reinsurance via especially Hannover Rückversicherung that Talanx own to 50.2%) and finally Financial Services (an internal reinsurance part for the entire group).

Active: In over 150 countries.

P/E: 13.7

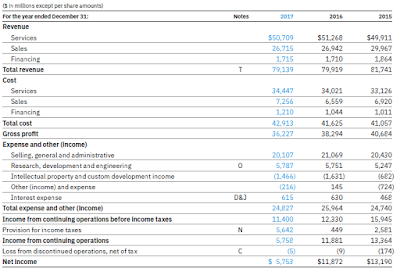

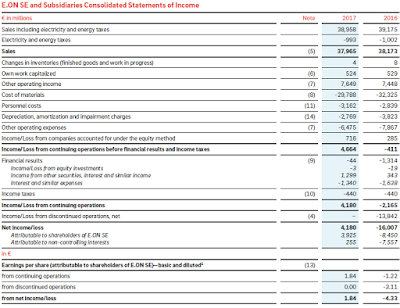

The P/E of Talanx is looking ok with 13.7 and the P/B is also great with 1.0 which gives us a go from Graham. The earnings to sales are very low with only 2% and the is awful with 7.6%. The book to debt ratio is ok with 0.7.

In the last five year they have had a yearly "revenue" growth rate of 3.5% which corresponds to a motivated P/E of 12 to 15 which means that Talanx is today fairly valued by the market.

They pay an acceptable dividend of 3.8% which correspond to 53% of their earnings so a bit on the higher side of things.

Conclusion: Graham says yes and I say hold. P/E, P/B and dividend look good but the ROE is simply not good enough. Without the end of year natural disasters 2017 could have been a great year but now it was not and there is no guarantee that 2018 will not be hit by major disasters. In my opinion one should buy insurance companies when they are severely pushed down and Talanx is today not there but are instead fairly valued. I will hold on to the shares I have but I will not increase my holding.