Company: Cez

ISIN CZ0005112300 | WKN 887832

Business: A Czech electricity producer and distributor. They offer heat and gas to consumers and are active with telecommunications, informatics, nuclear research, planning, construction and maintenance of energy facilities, mining raw materials, and processing energy by-products.

Active: Czech Republic, Poland, Bulgaria, Hungary, Slovakia, Romania and in Turkey.

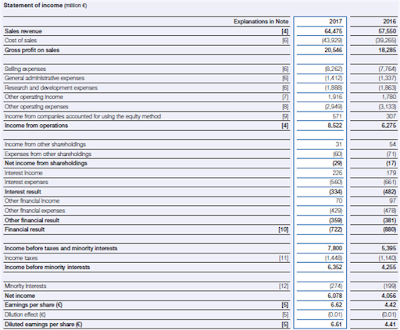

P/E: 14.5

The P/E of Cez is looking reasonable with 14.5 and the P/B is great with 1.1 which gives a clear buy from Graham. The earnings to sales are ok with 9% but the ROE is just not good enough with 7.5. The book to debt ratio is great with 1.9.

In the last five years they have had a negative revenue growth rate of -1.5% which is bad and it gives us a motivated P/E of around 10 which means that Cez is over valued by the market.

They pay an excellent dividend of 6.5% however this corresponds to 95% of their earnings so they need to stop this in my opinion since it is not sustainable and they have been doing this for a long time now.

Conclusion: Graham says yes but I say no. Sure the P/E, P/B and dividend is good but the ROE is not and considering that plenty of that earnings came from sale of business they are actually not as good as they look at this moment. I will continue as a grumpy shareholder.