Yesterday I came back from my vacation on Tenerife. This was now the second vacation of all inclusive that I have ever done in my life. The most important thing that must be ok is the food and it was ok but I still get fed up and bored of having three buffet meals a day even if there are some variations. Considering that I during work weeks are eating a fruit salad with yogurt and that I have been eating that for the last six years makes it pretty amazing that I can get bored of seven days of buffet meals but there you have it. We will have to think twice concerning the next vacation that we will book.

The highlights were to see a ray fish, Calderon Tropical whales, snorkelling among the rocks with all the fish one could see, and mount Teide. Driving on the small mountain roads were also an experience but not only positive besides from the stops and the views that one then had.

I also managed to finish two books during this holiday. One was about leadership so that I can improve myself and the second was about introverts because several of the members in my team are introverts and I want to become better at taking care of them. Both books contain much valuable information that I now need to try to apply in small portions.

Due to that there has been problems in one of the groups at work I will take over also that group. This now forces me to change the structure of the group so that I will have fewer people reporting to me and I need to create sub groups and I need to start leading managers instead of the team members directly. I have mixed emotions about this but I will now lead so many people that it cannot be done differently. I will now also be forced to report to two people instead of one which... well... is not awesome and especially since the new one is a nutter with zero leadership skills, zero tolerance and zero patience. As an example... he fires people that are not passionate about their jobs no matter how skilled or hard working they are. From my point of view it is my job, as a leader, to make people motivated and passionate about what they are doing.

Either way... this autumn will be interesting.

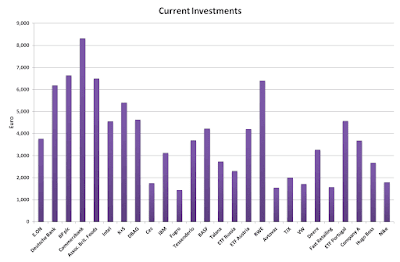

The total invested value is now up at: 87,190 € and I no longer include realised profits and losses into this value.

The value of the portfolio is today: 98,675 € and spread out I now have around 10,940 € in cash on the different accounts. I have a realised gain of 1,144 € and the combined realised and unrealised gain is now at: 11,485 € (13%) which is not as good as one would have liked.

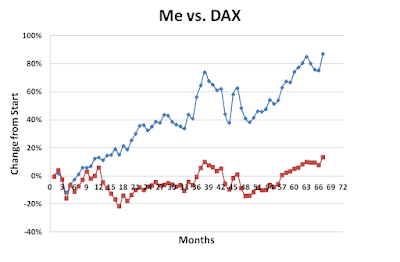

DAX have had yet another excellent month and is now up at 12,956 points which means and increase of 6.7% which should be compared to my own increase of only 5.5%.

Conclusion: DAX is having a great year and one need to start to wonder if it has been too great. I tend to think so myself. I am sitting with some of the rockets on DAX but unfortunately I bought them a long, long time ago and in between being rockets, as they are now, they were falling knives back then and the always keep and kept falling further than what I anticipated. Many of the companies are now trading around a P/E of 20 to 30 and this is NOT with poor earnings but with pretty decent ones. The stocks that I have on DAX are still trading below P/E 20 or have negative earnings and the one I found to be silly, Adidas, I have already sold (as always too early)