Due to the upcoming divorce I have decided to clean up my portfolio and to liberate cash. On top of this I will most likely not make any further investments for the coming half year to build up additional cash to pay for legal costs as well as to be able to transfer money to my soon to be ex-wife. The process cannot be started up until in November-January 2019 and the process will most likely take six months. So besides from building up the necessary cash to make sure that nothing further will be required it is better for me to spend money and to live a life of extravagance. It will be very difficult to convert my mindset but then again I should start dating again and that is never cheap.

I have also started to think seriously about marriage. In the past there were tax benefits, there was a protection for the housewife and the children but today in most countries these "benefits" neither exists nor are they needed. Both husband and wife are educated and earn their own living, children are protected by the society in general as well as other regulations so why should one then get married?

I will never marry again. If my, hopefully, future partner want to receive some form of security then that will be dealt with by writing a last will and testament. Both will of course write these and they can be signed in the presence of witnesses and afterwards one can have a "wedding-like" party. If the relationship will not work out then these documents can be ripped apart and in the meantime you and your partner can have a similar protection as if you were married. This is my idea to circumvent the old fashioned regulatory system that exists in most countries in the world today. Am I wrong?

Sold due to upcoming divorce as well as had being bought in a very annoying broker account that I tried out and was not very happy with.

I sold 77 shares (I still own 100 shares) that I bought for 2144.30 € and after fees I ended up with 2148.20 € on my broker account that was swiftly closed down after this sale.

This investment was made back in October 2016 which means that my holding period was 23 months and I made a 0.2% profit on this and no dividends has been accounted here.

To follow the journey of ABF please click

here.

Sold due to divorce but also since they had pretty much reached the 30% profit target that I wanted them to reach on top of things.

I sold all my 35 shares that I had bought for 2136.00 € and after fees I ended up with 2701.29 € on my broker account.

The initial investment was made in January 2017 which means that my holding period was only 19 months and in this period I made a profit of 26.5% as well as receiving almost 185 € in dividends.

To follow the journey of Hugo Boss then please click

here.

Sold mainly due to divorce. I also felt that I had too much in retail and could do with decreasing that quantity slightly.

I sold my 6 shares that I had bought for 2140.00 € and after fees I ended up with 2180.95 € on my broker account.

The initial investment was made in October 2015 which means that my holding period was 34 months and in this period I made a profit of 1.9% and had only received dividends in the size of 43.07 €.

To follow the journey of Fast Retailing then please click

here.

Sold due to divorce. I had previously stated that I was not happy with the behaviour of the managers in CEZ especially all the dealings that took place around buying out the coal power plants and coal mines in Germany from Vattenfall. I then said that as soon as the share price had recovered slightly then I would directly sell them off. Many of the power supplying companies have recovered so it was time to get rid of it.

I sold my 100 shares that I had bought for 2142.00 € and after fees I received 2229.10 € as cash on my broker account.

The initial investment was made in April 2014 which means that I had a 52 months holding period of this company. During this period I made a profit of 4.1% and I was additionally paid out 559 € in dividends which is not so bad.

To follow the journey of CEZ then please click

here.

Sold due to divorce. Probably the wrong moment to sell this company but I am not impressed with how few orders they managed to bring in considering that the oil price have been higher now for well over a year. So it felt good to clean it out of the portfolio.

I sold my 120 shares that I had bought for 2166.00 € and after fees I received 1392.70 € out as cash on my broker account.

The investment was made back in September 2014 which gives me a holding period of 47 months and during this period I have made a loss of 36% and I have received no dividends.

To follow the journey of Fugro then please click

here.

Sold due to divorce. The Austrian index (ETF Austria held by DB) had increased by around 40% and have remained there for a while. It was time to leave this investment.

I sold my 80 parts that I had bought for 3083.00 € and after fees I received 4356.12 € put as cash on my broker account.

The investment was made in March 2015 and I therefore have a holding period of 41 months. During this period I have made a profit of 43.1% and on top of that I have received 215 € in dividends.

To follow the journey of ETF Austria then please click

here.

Sold due to divorce. The Portugal index (ETF Portugal held by Commerzbank) have not increased enough but I needed a bit more money and for this reason I decreased my holding slightly.

I sold 380 parts that I had bought for 2264.80 € and after fees I received 2485.04 € out as cash on my broker account.

The investment was initially made back in March 2016 and I therefore have a holding period of 29 months. During this period I have had a profit of 9.7% and I have received no dividends.

To follow the journey of ETF Portugal then please click

here.

My average holding period for sold shares are now at: 35 months, almost 3 years.

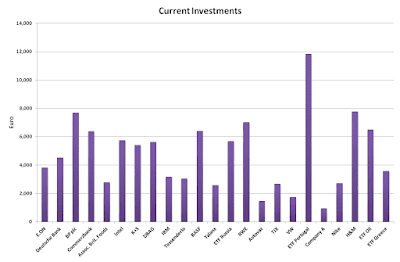

Any changes will be brought into the stock portfolio upon the next update in the very end of the month.