As I have already written was successful on the two exams and I have now managed to pocket 30 credits in macro economy. Next autumn the journey continues with business administration... at least I hope that I will be accepted but the chance that I would not is very low.

It seems as if a period of relaxation is starting now for me. We are getting almost no orders in the company and the projects that I have running demand very little time. I will therefore focus on trying to write and file at least one more patent in the coming two months so that value is still being created in the company.

In the end the month became filled with activity getting a visit from my family in Sweden and then directly going to visit the family of my wife down in the south of Germany. The trips down there is always exhausting me which most likely comes from that I have to focus intensively to be able to try to follow their discussions in their dialect.

The trip home to Sweden for summer vacation has now also been booked. We will leave in the very end of July and will stay for two weeks. I must then also make sure to order a new passport since that only costs around 40 € when done in Sweden and to make it here in Berlin I have to pay 150 € which I find utterly unacceptable for a passport lasting only five years.

For the previous report please visit Summary of May 2015.

Oh, I also decided to make a little change. I have since a long time found that the invested value pie chart is completely useless and have been thinking what I should use instead and in the end I decided that I should just run with the value of the stock portfolio.

The total invested value is now up at 64,115 € including the realised loss. The big change was that I pushed in money into Avtovaz (analysis of Avtovaz) due to the CEO since 1,5 years Mr Bo Inge Andersson.

The total invested value is now up at 64,115 € including the realised loss. The big change was that I pushed in money into Avtovaz (analysis of Avtovaz) due to the CEO since 1,5 years Mr Bo Inge Andersson.

The bad month continued and the portfolio is now up at 66,232 € which means that I now only have an unrealised profit of 2,118 €.

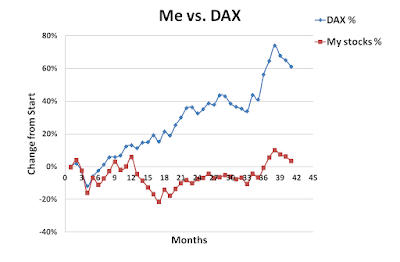

DAX dropped for another month and is now down at 11,155 points which means a decrease by -2.5 % compared to last month. DAX still beat me since my own portfolio decreased by -2.7% during the same period.

Conclusion: The same as last month... only by pushing in fresh capital did I manage to keep the total value of the portfolio to increase. I would be great to every now and then get a break and to have some stocks increasing in value. The big happy, happy joy, joy this month was K+S that have received a friendly offer from Potash. Rumours are saying a price of 41 € per share but nothing is official and negotiations are under way.

For the full portfolio report please go to the Stock Portfolio page and if you have suggestions for stocks that I should analyse then please go to the Analysis Requests page.

No comments:

Post a Comment