The annual report recently arrived from Kernel and here you can find that report and here is the contrarian analysis that was made based on the values from 2012. Kernel is using a broken year that ends in June and this means that the harvest from the previous year is not shown until the year after. This means that in the 2013 annual report we have the effect of poor harvesting in Ukraine from 2012.

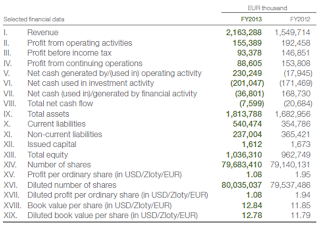

The highlights of the company can be seen here and is directly extracted from the report and is in USD:

To me these are not really highlights and I must admit that they were very cautious in what they did highlight in the report. They more or less only said that revenue was up 35% from 2012 to 2013, which is not shown in the above graph but in the below one. We can very clearly see that the EPS have significantly decreased so why is that then when the revenue increased that much?

After digging some in the report I found that yes, the revenue increased by 35% but the cost of sales increased by 47% and this is part of the problem for the decreased profit. Kernel had a poor harvest and to keep the grain storage, harbour as well as sunflower presses running they have been buying a lot of grain and seeds which has significantly increased the costs of sales.

Kernel have continued to increase their areal in Ukraine and are now leasing or owning 405,000 hectares of land which makes them the third biggest in Ukraine. They have sold off parts of land that were not connected and have started to centre more and more of the land to be able to push the benefits of large-scale farming.

Conclusion: Kernel had a profit wise bad year but revenue wise excellent and they keep pushing it higher with increased focus of their business. With increased revenue then also profits will most likely arrive at some point. I guess that is the only reason for why Amazon is so highly valued because profit wise they are a disaster. I like what Kernel has done as of yet. I hope that the weather gods will favour us so that the harvest this year will be much better. I will keep the company and due to that the stock has significantly decreased in value I might even increase my quantity of shares.

I will make an update of the contrarian analysis of Kernel and post that tomorrow.

No comments:

Post a Comment