Cez arrived with their Q2 report for 2015. The share price hardly ever moves for Cez unless it is the day that they pay out the dividend so I really do not know how the market accepted the report.

For the report in full please go here, to see the previous summary please visit Cez report Q1 2015 and to find out more regarding Cez then click on analysis of Cez 2015.

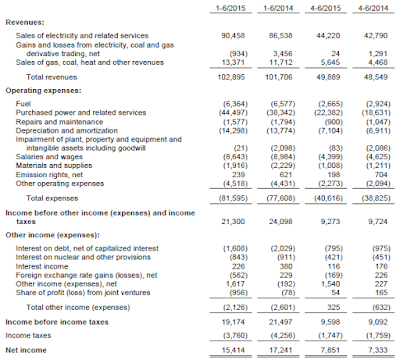

Last quarter I was not so happy with the result from Cez and looking at the running half year below we see that they at least managed to stabilise themselves. The sales are still looking very good with an increase of around 5% but the earnings coming out are stilled weighted down by the poor Q1 and we are down by -11% which is still bad but better than the -25% that we had from Q1. The purchased power and services are still costing far too much also during Q2 so we shall see how that will go in in the future. There were also large losses from foreign exchange as well as from their joint ventures.

Conclusion: Of all my electricity companies Cez is still among the best performer but at some point in the future I suspect they will end up in the same trouble as E.On and RWE due to their electricity production not being considered very green. There I am much better off with my Enel investment that are, already today, more aligned with the future demands. I will remain as shareholder in Cez.

4 comments:

If you want a green producer, have a look at the austrian Verbund ;).

Hi Matthias,

I did not know about them before. Thanks for informing me and I will most likely analyse them also.

Generally the Austrian market is looking very attractive today which is why I bought the index fund there. I have for a long time considered to buy also single companies. If one would only have had more money...

The "problem" of the ATX is that is highly dominated by bank, insurance and real estate companies which make about 45% of the Index.

OMV has to my knowledge also a couple of %-age of the index so yes it is plenty pushed down which makes it so attractive. That one can get an ok sized oil company such as OMV for a P/B of 0.5-0.6 is almost as good as Gazprom (I think around 0.4-0.5 right now) but the political risks are very different and strongly in favour of OMV. Still the Austrian index fund will do me just fine at the moment.

Post a Comment