Another month of overall increasing share prices in the German market. I have continued to build up capital during the month for my move so there is no investments to report. We have asked several moving companies and the prices varies from 3,700 to 5,000 €. Insane much money! I would have loved to sell all the stuff but my better half do not want to do that even though the value of our stuff does not even get close to 3,700 €...

I did in the end get the job in Sweden but we decided that we would stick with the UK experience that is approaching with giant leaps. One and a half month from now we will be there trying to find our way around in the UK society.

Due to this I cancelled my online summer studies in Sweden and I will need all time to make a good impression at my new job in the UK. This will then also mean that the blog activity will significantly decrease for the very same reason.

My thought today is that I will freeze my German stock portfolio, only make reinvestments from dividends and keep a 1,000 € cash buffer on the account. My plan would then also be to only make yearly reports on those companies which will dramatically decrease the amount of publications.... I need to think a little about it... I mean I want to start looking at companies in the UK to start investing there once I have cash to do so again and my UK stock portfolio would then be my active one.

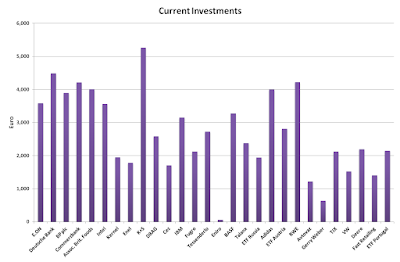

For the previous summary please visit Summary of March 2016 and here you can see my stock portfolio as it is.

The total invested value is now up at: 81,975 € including a realised loss of -3,757 €. No new investments were made.

The value of the portfolio is today: 74,942 € and I now have around 1,400 € in cash on the account due to that dividends have dropped in during the month. The combined unrealised and realised loss is now at: -7,032 € (-9%) which is bad.

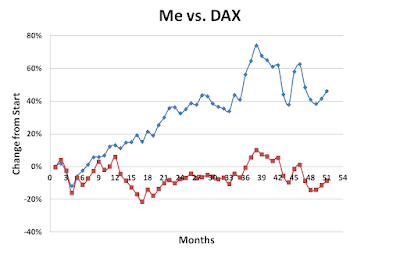

DAX improved during April and are now at 10,123 points which means an excellent monthly gain of almost 3.3% which is a good month and it was better than my portfolio that only increased 3.0% it should however be mentioned that my companies have started to pay out dividends which makes a difference to the DAX index.

Conclusion: DAX did indeed beat me now that me dividends starts to be paid out so it is nothing strange but still... I would prefer to be on the other side of the coin.

No comments:

Post a Comment