|

| Summary of April 2020 |

It's been several weeks of sunshine that I've managed to enjoy a bit of each lunch when I go for my daily allowed exercise which tends to be a walk. The shelves in the stores now have much more items but the queues to get into the supermarket with the social distancing are still around 30-45 min.

With each passing week my workload keeps reducing. My entire team has now been placed on furlough sauf moi. Due to the reduced workload I have now significantly increased my blogging activity, I've started to take lessons in French to make sure that I do not forget it and hopefully will even improve it a bit, I've intensified my leather crafting hobby and finally I have started to study on the Open University here in the UK.

I still need to get on top of the dividends in 2020 but I have left that on the back burner until I have analysed the companies that I currently own.

Boris is now also back in office. I'm not happy about him being the PM but I am glad that he came out safely from the hospital and have now recovered so much that he can start working again.

Share prices have started to rise a bit again which, I am sorry to say, I think is optimistic. Companies are not operational. We still have no clue how long this will last and the entire logistic chain as well as supply and demand is unknown.

For the previous summary please visit Summary of March 2020 and here you can see my stock portfolio as it is.

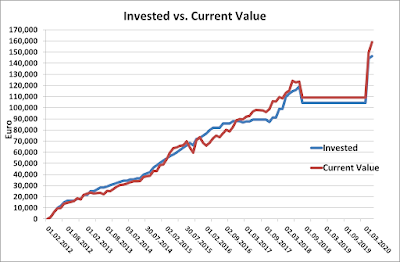

The total invested value is now up at: 146,320 €. The monthly investment in the Mixed ETF has been done but besides from that nothing else.

The value of the portfolio is today: 158,834 € and I have 2294 € in cash on my broker account. I have realised gains of 3,103 € (sold off losses) and unrealised of 12,514 € (7.9%) which, as always, not good enough.

Conclusion: It has been a better month for me than what it has been for DAX. I have cash on the broker account that is ready to go but I have not yet decided if I should invest more in one of my current holdings or if should pick something new. As example I have nothing in construction, property or forest industry and now could be a good moment to bring in a good company from one of these industries into my stock portfolio.

No comments:

Post a Comment