|

| Summary of November 2022 |

War have not yet stopped. The world championship is going on with surprising results in many cases which makes it more exciting than usual. I must admit I have not been watching that much but difficult not to be updated.

The pound sterling has increased in value compared to the euro which have given me a bit of a boost this month because I have not made any investments.

We've now made the cuts in the company, and I did in the end offer myself up for removal which was unfortunately not accepted. So now I will be the little girl, holding a burnt-out match behind her back, watching the house burning to the ground. The employees are really not pleased about what has happened. Salary increases will be difficult for many companies this year. The inflation has been significant, but we have no one to pass that on to so I will not expect any major changes.

Christmas is around the corner. Instead of a one-way ticket I had to buy a return one and I will as always go to Berlin for Christmas market which will, as always, be nice, before I go back home to Sweden for almost two weeks. I hope there will be some snow so that I can bring out the old 2nd hand snowboard. Please be sensible when buying gifts this year. China and India are buying up all the oil from Russia and are putting that into polyester garments, toys etc. We do not want to support this ridiculous ongoing war that purely comes from the ego of one man and neither Ukraine nor the Russian population is happy about it.

For the previous summary please visit Summary of October 2022 and here you can see my stock portfolio as it is.

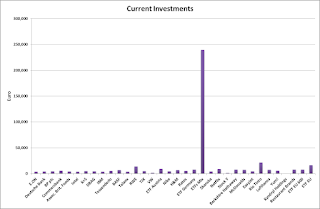

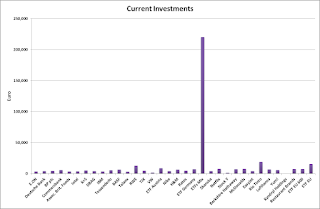

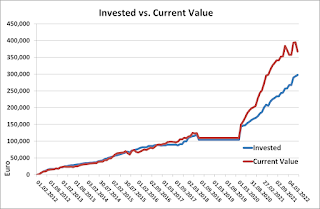

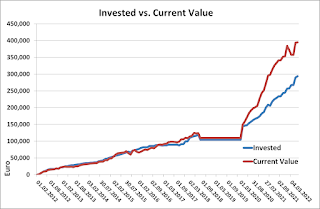

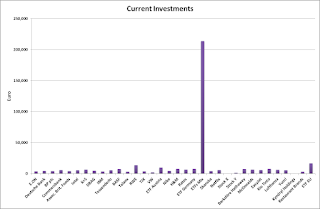

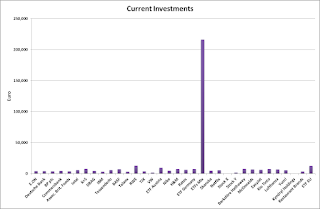

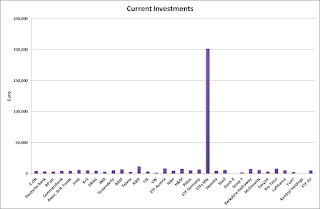

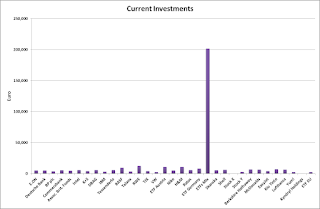

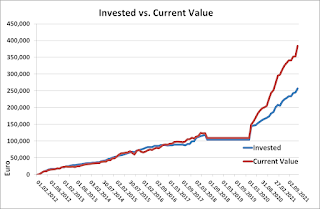

The total invested value is now at: 332,847 €. Monthly investments made in ETF Mix but nothing else.

The value of the portfolio is today: 446,489 € and I have 1,476 € in cash on my broker accounts. I have realised gains of 4,547 € and unrealised of 113,642 € (26%) which is not good enough and mainly pushed due to sterling value. My ETFs are now up at a value of 63% of my portfolio.

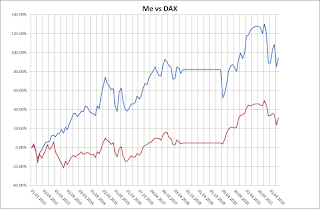

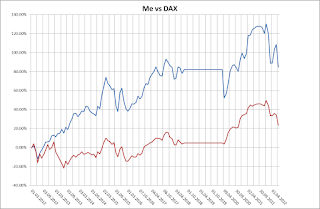

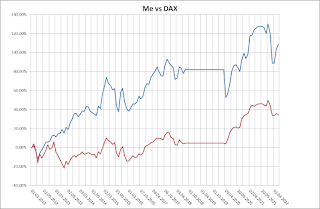

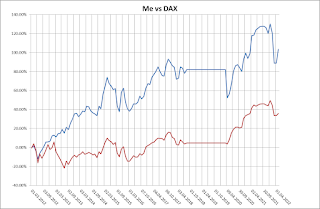

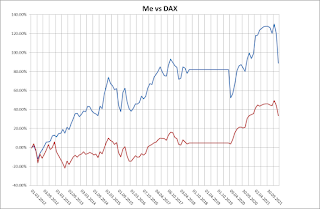

DAX is now up to 14,529 points which means that it has increased by 7.9% since the previous summary and my own portfolio has only increased by 5.8% in the same time period.

Conclusion: Ugh! DAX had a great month and so did my portfolio but just not in comparison. Christmas will cost money, so I've got little to spare for investment even though it is a good moment to shuffle sterling over to euro.