|

| Summary of January 2022 |

Few dividends have arrived and I'm making this summary early due to a ski trip with my family in Sweden next weekend meaning I will be gone for two weekends in a row so this was the best opportunity to report on the developments. Stock markets have gone down and without bringing in more money things are not looking at its best right now for me. As you all know I really do not care.

Received a miniscule salary increase and an acceptable bonus payment, both should arrive on Monday. On my UK stock ISA I'm only allowed to add in £2k more this tax year meaning that I will add in those 2k this month and make one investment but after that I will just have to sit on cash until early April when the new tax year starts again here in the UK. Annoying!

I keep looking at properties in France, and every now and then I see something of interest, however I cannot yet act on it. Smaller vineyards can be bought for surprisingly little money however they then never have a house on them and they have not been run properly either so plenty to do to get it up and running again if one would wish for that. I need to find out more about building permission in France.

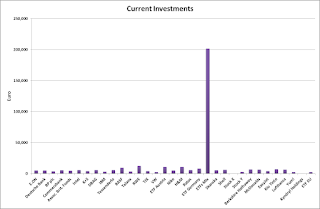

For the previous summary please visit Summary of December 2021 and here you can see my stock portfolio as it is.

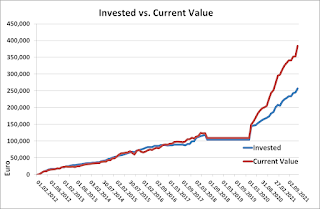

The total invested value is now at: 257,321 €. Monthly investments have not been made since the last report.

DAX is now down at 15,266 points which means that it has decreased by -4.3% since the previous summary and my own portfolio has decreased by -5.2% in the same time period. Mainly my ETF Mix have been hit very hard.

Conclusion: DAX have performed slightly better than me this month and the big bulk of reduced unrealised profit has been with my ETF Mix. Omicron, energy prices, interest rates and Ukraine/Russia is likely to be the headlines. None of which I can change and hence I continue and as always... I wish I would be sitting on more cash to push into investments now. I will soon have that but I'm limited with my Stock ISA anyway. I hope all of you are sitting in a better situation today!