|

| Summary of October 2022 |

War is still ongoing in Europe even though the world seems to already have forgotten about it. The dollar has become very strong compared to many other currencies. Election in Sweden with a strong wind of anti-immigration and UK are going through unelected PMs faster than one can file a tax declaration.

My apologies for the late report. I've had vacation, been to an international conference, had Covid and then contemplating my future due to the upcoming and now finalised board meeting. The wind of change is blowing. It is a good, good time to look and execute on changes that needs to be done for improving one's life and work situation. One should never keep going to a job if one is not happy about it and as the saying goes: Love it, change it, leave it.

I've decided that it is time to move on and as you will see in the report below, I am not that far away. I calculated that I needed 350k € and then I wanted another 100k € for buying and restoring a property. There are cuts coming in my company and the best for the company will be to cut me out. The CEO will not want to do that, but it will be the best for the future of the company and after devoting over 6 years of my life to the company I want it to be successful, which means that there must be employees left working with their hands, which the new CEO appears to not acknowledge...

Yesterday I filed my tax declaration and had a couple of sweaty hours due to the calculations claiming that I owed ~11,500 £ in taxes. Had serious issues to find out what had gone wrong but managed in the end and will now instead receive ~1,000 £ back in on my taxes. #Sigh of relief#

I started hoarding some cash but, in the end, I decided to move money over to my German broker to have more investments in the currency of my future EURO!

For the previous summary please visit Summary of July 2022 and here you can see my stock portfolio as it is.

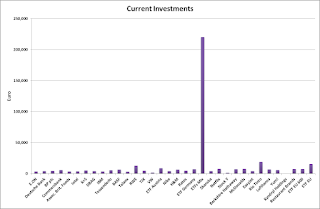

The total invested value is now at: 321,868 €. Monthly investments made in ETF Mix and then I also invested in Rio Tinto and ETF EU 600.

The value of the portfolio is today: 416,279 € and I have 1,348 € in cash on my broker accounts. I have realised gains of 4,547 € and unrealised of 94,411 € (23%) which is not good enough and dropped down further lately. My ETFs are now up at a value of 62% of my portfolio.

DAX is now down to 13,460 points which means that it has decreased by -0.2% since the previous summary and my own portfolio has decreased by -2.1% in the same time period.

Conclusion: Both DAX and my own portfolio have dropped down since the July report but have now started to recover again. DAX more so than my own portfolio. My USA stocks such as Intel and Nike have pretty much dropped like stones... as an example Intel used to be +200% plus and are now only at +46% from purchase value, which is sad to see. Fingers crossed on that my discussion with the CEO is going well tomorrow.