|

| Summary of July 2022 |

What can one say? Is war still going on. Yes, it is. Is Covid still raising its banner in the world? Yes, it is, however fewer have a serious impact. Is travelling still a nightmare in many airports? Yes, it is. Is supply of materials still a nightmare? Yes, it is. Is inflation and interests going up? Yes, it is. I see few things to be cheerful about however I also have the built in resilience that people will still consume and companies will still make products so I'm not worried about any of the developments on the stock market.

I managed to go to the south of France for some camping. It was a great experience and I've never done river hiking before but it was the greatest ever! To walk in the cold mountain river, while having temperatures above 35 deg C. It was great! Funnily enough I avoided the heat wave that arrived to the UK with over 40 deg C on one day. Pity that I missed it.

I've now completely filled up my stock ISA and will most likely be hording cash for the time being.

For the previous summary please visit Summary of June 2022 and here you can see my stock portfolio as it is.

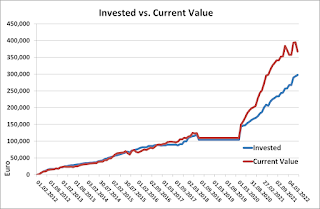

The total invested value is now at: 302,590 €. Monthly investments made in ETF Mix and Restaurant Brands.

The value of the portfolio is today: 397,851 € and I have 3,414 € in cash on my broker accounts. I have realised gains of 4,547 € and unrealised of 95,262 € (24%) which is not good enough and dropped down further lately. My ETFs are now up at a value of 63% of my portfolio.

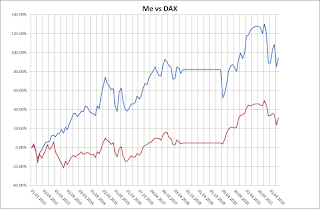

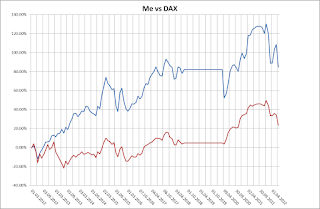

DAX is now down to 13,484 points which means that it has increased by 5.2% since the previous summary and my own portfolio has increased by 7.7% in the same time period.

Conclusion: Both DAX and my own portfolio have made a recovery during July. I can not invest any further money in the UK for the time being so I will be holding onto cash. Elections have or are going on in many countries so it will be interesting to hear the populations opinion.