As many of you know, and probably shake your heads about, the investment for last month became Avtovaz. This is my second investment that is purely based on the management. This also means that a completely new holding was yet again started. Some investors want to be focused with few holdings and based on how I act I am very clearly not one of those. Good? Bad? Right? Wrong? Who cares. There are even more ways to be a successful investor then there are companies in the world and of course the inverse is also true.

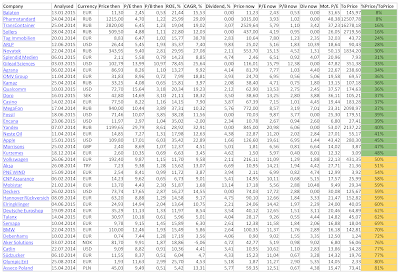

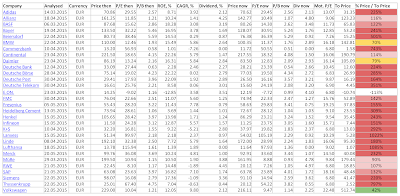

It should be mentioned that two companies were kicked out namely Ladbrokes and Picanol since their valuation was now so high that it would be less interesting to jump in as a new shareholder. This does however not mean that one should sell it. Due to the companies that Falk asked me to analyse there were also some additions to the list and the top ten are now: Balaton, Pharmstandard, TransContainer, Sollers, Tag Immobilien, ARLP, Novatek, Splendid Medien, Gilead Sciences and Agrana.

Car producers are still cheap and MüRe and Lufthansa I still find of interest for making an investment. Especially MüRe considering that all the managers have been shopping like crazy as I reported in the German inside trading: June 2015.

There are still several of my companies that I could consider to push in more money into. The banks for instance that never seem to be able to recover for all the years that I have owned them. The energy companies also but at least they pay out an acceptable dividend. I find some of my holdings too small based on what they have actually given back to me as well as how far they are from what I consider to be a fair value so MüRe and Enel are then sticking out a bit.

Conclusion: My biggest interest based on several factors are to increase in MüRe. The price have dropped even a bit further since last month which makes it now even more attractive as well as all the insane insider activity that took place. I simply must increase in MüRe.

4 comments:

Hi

You know I'm a fan of Picanol. The stock price has risen indeed very fast the last months, but I think it's still cheap. The market value is around 875Mil. They own 30% (and rising) of Tessenderlo Chemie. You own that stock so you must have heard that the turn around is happening right now and they are investing heavily in updating and expanding their production (==> rising sales and let us hope rising profits). Current market value of Tessenderlo 1.5 Bil. (30% = 450Mil) So the current value of the actual Picanol business is 875 - 450 MiL or 425 mil. That business is also going great, they are hiring additional work force to cope with current demand (low euro and technological market leader in their niche market) Profit for this year is estimated at 60-70milj. And that is almost all free cashflow. (425 milj for a business that generates in a good year 70 milj free cash flow, i find that very cheap) And you know Luc Tack likes investing that money as it creates more value then just giving it to the shareholders... (See the recent activity in the Tessenderlo share price) So there are a couple of options for generating additional share holder value, all within 1 stock. It should be high on your watch list instead of out ;-)

Hi Garry,

I know you are a fan of Picanol and so are many in Sweden since the value bloggers there have pushed out a buy recommendation on Picanol some months ago, which could be part of reasons for the latest share price increase.

My issue is still the less than 11% free float Garry and for that reason in combination with a 100% share price increase it was dropped from the mechanical stocks of interest list.

I am sure that Picanol has a bright future ahead of them and as you calculate they are still cheap to fairly valued at the moment they just fall outside of the mechanical formula.

Hmmm... are you sure that the share part in Tessenderlo is rising? I thought that Luc Tack was buying either privately or with one of the companies that he owns above Picanol... but maybe I misunderstood that.

You can check belgian insider transactions here (if you understand a bit Dutch or French ;-). These are the recent ones of Tessenderlo.

http://www.fsma.be/nl/Supervision/fm/ma/trans_bl/TransactionsSearch.aspx?s=1&from=&until=&c=tessenderlo

It's mainly Verbrugge NV that is buying, which is 100% owned by Picanol...

Thanks for the link Garry! Yes, Verbrugge, owned by Picanol, stands for more of the transactions and fewer are done with Symphony Mills that, on the other hand, owns Picanol. So when Picanol push money into Tessenderlo Luc Tack gets 90% and when Symphony Mills does it he gets 100%.

Interesting to see how Luc Tack is increasing his cross ownership of Tessenderlo by pushing so much capital into it from all directions. I mean.. complete control of it he already has so now it is a matter of increasing his future profits. I am still happy to sit in the Tessenderlo boat on this one.

Post a Comment