Due to that I had missed the filing of VW Q1 report I of course include that in this report. To read the report in full please go here and to read the previous summary then please click on VW annual report 2015 and to find out more regarding VW then please visit analysis of VW 2016.

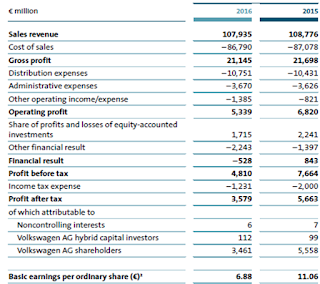

Conclusion: In Q1 VW did not do very well. The sales revenue were down by a couple of %-age according to them due to exchange rates. They did however deliver more cars. More people seems to be leasing their cars because their financial services showed a nice growth for the quarter. Not so good is the drop in earnings that were around -20%. Still the company made money. I like when my companies make money in each quarter.

In the Q2 report from VW there are some unpleasantness named special items that is in the size of almost -2.5 billion EUR. I do not like special items that decrease results.

Conclusion: They are still pretty flat compared to in 2015 and they keep claiming lowered revenue due to exchange rates. Without the "special item" the earnings for VW would have been ok but with it, as it is now, we are down by over -35% in earnings which is a lot.

Here we have the report from our Russian friends in Avtovaz that decided last spring to kick out the Swedish CEO. Did they do any better I wonder? For the report in full please go here and to read my previous summary please click on Avtovaz report Q1 2016 and to find out more regarding Avtovaz then please visit Analysis of Avtovaz 2016.

Conclusion: The sales are down a little for the running half year but they have still not managed to get costs under their control which is bad news. They have a wonderful impairment cost that made me laugh. The new CEO seems to like financial engineering. This huge impairment cost comes from a discounted cash flow model concerning the situation in Russia today and what that might look like in the future and if they will not reach their targets in 2019. So... eh... yeah... let us add that as an impairment cost in the size of 20% of our current revenue because that sounds about correct.