This group is complicated to report on since almost all of them are running broken years and additionally I decided to bring in ABF into retail even though they are still so much more than retail... either way here goes...

Adidas

I am very certain that this report was well accepted. The share price has gone from around 110 EUR up to 155 EUR before it dropped down a little again to 145 EUR which it is at today. The report is excellent and yet there are difficult matters in it.

For the report in full please go here and to see my previous summary please visit Adidas report Q1 2016 and to find out more regarding Adidas then please go to analysis of Adidas 2016.

The financial statement below is impressive. The net sales are up by 15% but they have managed to control their costs and for this reason we end up with a net income that is up by almost 70% in comparison to 2015. Impressive! With the Olympics etc. in 2016 it has turned out to be a very strong sports year. The sales in the USA as well as in China has completely exploded! So many signals have indicated that the US consumer is careful... well... apparently not for buying Adidas products.

Still... South America as well as Russia showed very weak results. Additionally, Reebok, TaylorMade-Golf and CCM-Hockey did not perform at all. All the strength and sales came from the Adidas brand and I must say that the Adidas products that I saw in the Olympics simply looked good. Well designed and beautifully made not like the Puma Switzerland football shirts that got ripped apart when the wind was blowing a little in the European championship.

Conclusion: Adidas have already in the first half of this year made as much money as they did for the full year of 2015. People have started to collect their earnings as would I have done if I would have had more of a focus. Still... if South America takes off and Russia as well... Hmmm... and China have started to buy the real brand and not fake versions... yeah, the journey has probably still not ended and I just managed to buy them at the very insane low price which makes me want to bring home my profit but I will suck a little more on my thumb here.

Associated British Foods

ABF have arrived with two reports in the meantime and only one of them, their half year report, contains numbers and their so called trading reports are just a bit of a chit chatting to be honest.

The report in full can be found here and for the previous report please visit ABF report Q1 2016 and to find out more regarding ABF then please check out the analysis of ABF 2015.

In the financial statement below things are looking ok but that is also all to say about it. The revenue is down and due to some cost control the earnings in the end is a bit up compared to last year. They keep coming with their adjusted this and that which I do not like but it seems to have decreased a little... could mean that things are actually looking better but well... who knows.

Conclusion: The most disturbing thing with Primark here in the UK is that they do not look more active, with their sales, than a normal H&M. They are far, far away from how it was in Berlin when I saw the stores there. Sure, normality always arrives and it is stale. Still, they are expanding hard and as long a company does that they will also keep growing their revenue and most likely their earnings.

ABF also arrived with their Q3 report and in it the only things mentioned of interest is that sugar seems to start to improve mainly due to increased prices but also due to cost control. They also expect to get mixed benefits due to Brexit and decreased valuation of the GBP.

Conclusion: In their Q3 report, which is a three pages report, there is not much to say. I was disappointed that the growth of Primark is not increasing by more than 7%. That disturbs me.

Fast Retailing

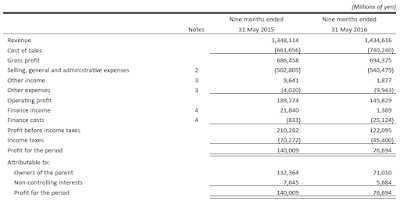

Fast Retailing and Uniqlo is another one of those companies with a broken year and for this reason the report concerns Q3 2016. The report is bad and I am not impressed.

For the report in full please go here, to read the previous summary then please click on Fast Retailing report Q2 2016 and to find out more concerning Fast Retailing then please visit analysis of Fast Retailing.

In the financial statement below we can see that they keep paying in earnings for their push in revenue and market share. Their 6% increase in revenue gives -47% decreased earnings. On top of this poor performance they even had to change their projections for the full year 2016 to much, much worse from something that already from the start was not very impressive at all.

Conclusion: Fast Retailing needs to tie up their costs and here we have yet another one of those companies that are pissing around with derivatives. Well done guys! I love their stores and I find that their cloths look good but they need to shape up!

Gerry Weber

Ooooh... wooow! This report is smashing! It follow the exact same trend as were seen in the Q1 report and already that one was amazing. Ralf Weber, please resign and please board give the position to the Hallhuber guy that seems to have some clue about the business.

To see the report in full please go here, to take a look at the previous summary then please click on Gerry Weber report Q1 2016 and to find out more regarding Gerry Weber please visit analysis of Gerry Weber 2016.

In the financial statement below there is nothing to be happy about. Nothing. They keep living on the shoulders of Hallhuber and on their own they are losing money. Unacceptable.

Conclusion: Ralf Weber is not the right man for the job so please kick him out. They are pushing a new silly program called "FIT4GROWTH"! Are they little computer kids from the 90s? Adults should be able to write out proper words. Put the Hallhuber guy in charge and clean out the trash.

TJX

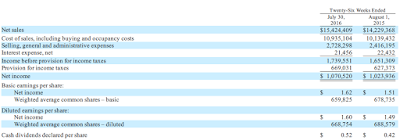

The American giants they just keep on delivering. It is almost always an enjoyment to dig into the reports and also in this situation I am pleased.

To read the report in full please go here, for my previous summary please visit TJX report Q2 20156and to find out more about TJX then please click on analysis of TJX 2016.

In the financial statement below we see a consistent increasing revenue and even better we see a consistent increased earning and dividend payment. On top of this they also increased the guidance for the full year and this is in a period when the value of the USD has strengthened.

Conclusion: TJX is doing well and I am happy to be a shareholder in this American giant. They will keep growing in Europe and they will keep pushing for getting into those 40 billion USD revenue!

Overall Conclusion Retail: These companies are stretching from major home market being in Asia and Japan to Europe and going further to the US. Adidas is showing that Asia is doing but Fast Retailing shows that Japan is doing badly. ABF indicates that UK is not doing so good but the rest of Europe is ok. From Gerry Weber we can not extract any information since the CEO is useless and Germany is actually doing very well which we did not see from that report. TJX is showing that US is doing pretty good as did Adidas so that is good news to me especially since ABF is establishing themselves there more and more with now three opened stores.

No comments:

Post a Comment