In the energy group I pushed in Cez, E.On, Enel, RWE and Uniper. The only company that have done semi good for the last couple of years has been Enel and E.On is the big value destroyer. After reading the report from Uniper I know see how E.On made themselves "clean" and "green" after being forced to keep the nuclear. They have leased out all their nuclear plants including a lot (all?) of the liabilities to badabum! Wait for it.... wait for it.... Uniper! When a government force you to do something then as always... if there is a will then there is also a way.

Cez

For the report in full please go here, to see the previous summary please visit Cez report Q1 2016 and to find out more regarding Cez then click on analysis of Cez 2016.

In the financial statement below we can see that the happy days in eastern Europe, if they ever started, have definitely started to be mixed in with some bitter sweet ones. For the running 6 months we are down with almost -6% in sales and the net incomes is down by almost -11% which is no good at all. Everything looks ok besides from this drop in sales which drags down everything.

Conclusion: Last quarter it looked as if Cez had things under control by having decreased costs to follow the decrease in sales. This quarter the costs seems to have caught up with them and earnings have made a significant drop especially considering that they were up at 9.9 billion CZK after the first quarter. They do however still make money which is not always the case in this line of business which means they are doing ok. I will remain a grumpy shareholder.

E.On.

For the report in full please go here and to see my previous summary please visit E.On report Q1 2016 and to find out more about E.On then please go to analysis of E.On 2016.

In the financial statement below things are not looking bright. The sales keep dropping year after year, quarter after quarter. They had almost no earnings to report in Q2 and due to handing out Uniper to their shareholders we end up with a big, big minus for the period. One would have hoped that Uniper then at least looks good but we all know that hope is what dies last.

Conclusion: Things are for the fourth year in a row looking bad for E.On and what I thought would be one or two tough years have ended up being a long running show with few viewers. I should have left a long time ago and yet I remain as a grumpy shareholder.

Enel

For the report in full please click here and for the previous summary then visit Enel report Q1 2016 and to get a better feeling for Enel then please take a look at analysis of Enel 2016.

In the financial statement things are looking ok. The first reason for claiming that is because yes, they are also decreasing their sales but still Enel comes out with some good earnings and have not been forced to write down anything for the 10th time in a row so yes I am happy with this. Sales down, costs down and earnings flat.

Conclusion: Enel is doing ok. Many other companies are forced to split up their business but Enel does not have to do this which means that their future progress might be even better and they will for sure jump up on the list of largest European energy providers.

RWE

To read the report in full please go here, to see the previous summary then click on RWE report Q1 2016 and to see the previous analysis of RWE 2016.

As can be seen in the financial statement below also for RWE the sales are decreasing as well as every other company. Costs are not down and with some heavy finance costs we end up with as little as 0.74 € per share which is much less than last year but then a large part of the "earnings" came from sale of business.

Conclusion: RWE is doing so, so. They have also decided to split up their business in the future just like E.On did so we shall see when that rabbit arrive to the portfolio. I will remain as a shareholder in RWE.

Uniper

To read the report in full then please go here. Unfortunately I have neither analysed nor written any previous reports regarding Uniper.

What can I say... anything that Dr. Teyssen have kept his fingers on is apparently a company going down the drain. It is sick to see how Uniper is doing and what they are forced to take on from E.On.

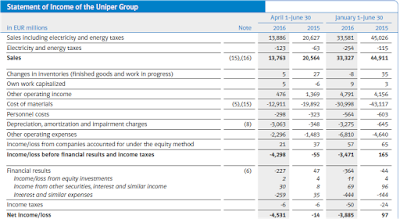

In the financial statement below we see a crazy decrease in sales. We see large costs and very large depreciation. I also love to see "other operating expenses" that are in the size of 6.8 billion € and yet was apparently not deemed important enough to get mentioned in a note. We are talking about a share price of Uniper in the size of 10 € that are reporting losses in the size of -23 € for the first half of this year. Well done!

Conclusion: By the look of it Uniper is off to a good start helped along by our all time favourite Dr. Teyssen. I would not be chocked if they would ask their shareholders for more money soon. I need to think a little what to do with this holding.

Overall conclusion: The energy sector is still not healthy. Some of them are able to present a bit of earnings but one never knows if they have yet to do another write-down on something which makes it very difficult to be a shareholder. My contrarian thought that one could just walk in and buy any company when an entire branch drops is by the look of it wrong. One must still be very selective and maybe even more so since it does indicate that some of them could go under.

No comments:

Post a Comment