My stock buying have still not improved and I am not saving as much as I should be doing at the moment. I need to improve that! The only reason why I ended up buying something during April was due to Deutsche Bank and that was not even initiated by me so I need to shape up on that.

This evening, to my horror, I discovered that I have not been directly accepted to the two summer courses that I have applied for. I do not understand that at all and something is odd because if I do not forget to apply on time then I am in principle 100% certain of getting accepted due to academic points + grades from school. I wonder what has happened and if I should take a battle on the matter or not. My biggest focus right now should be to file the tax declaration for my final half year in Germany. They are clever little buggers.

Each time I have moved from one country to the next I have almost always received money back from the tax office due to that you pay monthly taxes based on the expectation that you will earn that each month for the full year. When you leave in the middle of a year this then always leads to you getting money back.

The clever buggers in Germany demands to see you salaries from the new country. If you then continue to earn similar then they claim that you obviously had the correct tax rate for the year and you get no money back... you might even end up paying them some money if your earnings sky rockets! On the downside for the German tax office you are allowed to deduct moving costs which makes the declaration no fun at all but they have forced me into a corner on this one.

Work is currently stressful but I enjoy my time there very much.

Oh, and I seriously need to finish up the yearly reports and new analysis of all my companies. I am late on that. It should also be mentioned that the pound is disturbing me more and more and I start to consider to shuffle money back to Sweden as a protection for the future...

For the previous summary please visit Summary of March 2017 and here you can see my stock portfolio as it is.

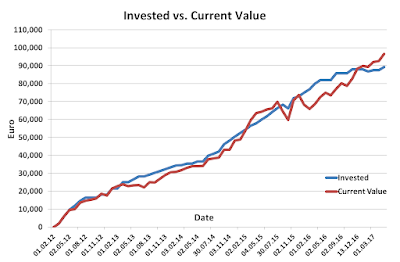

The total invested value is now up at: 89,217 € including a realised loss of -551 €. I did end up buying 140 DB shares.

The value of the portfolio is today: 96,505 € and spread out I now have around € in cash on the different accounts. The combined unrealised and realised loss is now at: 7,288 € (8%) which is not as good as one would have liked.

DAX did very well during April and is now up at 12,508 points which means an increase of +1.8%! My stock portfolio did however perform slightly better during April and went up with 2.5%.

Conclusion: I had a good month but much of this was due to DB and temporary currency effects. I still have a, for me, fairly high %-age of cash that probably should be invested into ETFs.

No comments:

Post a Comment