Some weeks ago ECB finished their stress test of the banks in Greece. There were some commotion around it because one CEO stepped down etc. but the general information given by ECB was that they all passed the stress test. Unfortunately the index in Greece is to a large extent dominated by their banks and if they would not live up to the requirements by ECB then the index would be far, far away from any form of recovery. Now at least there is a chance for this to happen. Looking into the financial statement of the banks then they are still not doing well but my thought is that if they have now passed the requirements of the ECB then they can reallocate their resources elsewhere which would for instance be into making money.

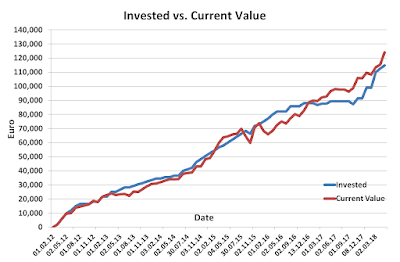

I think that I might still be a couple of years too early with this investment but sometimes it is good to make it so that one keep watching it. On top of things I hardly had any money this month due to two reasons: Break down of cars and being forced to repair them and secondly massive, for me, expenses that I must carry for the company. I doubt that next month will be better.

I therefore bought 130 parts at a total cost of 1127.69 € including fees.

To take a look at my current Stock Portfolio then please click on the link. The portfolio will however not be fully updated until the end of the month.