|

| Summary of February 2022 |

Ski trip was great even though I could not spend as much time as I would have liked with my brother and my cousins families and I also came to the conclusion that skiing in Salen is good but it still feels small. I need to improve my snowboarding skills also...

Plenty of things are going on in the world at the moment that have a negative impact on the stock market. Russia/Ukraine is the big one at the moment, the upcoming increase in interest rate in the USA indicating that the party must start to be reined in, energy prices have kept increasing and of course not to be forgotten Covid. China is still running a zero tolerance policy which is significantly hurting their businesses at the moment while most of the world have started to relax the regulations.

A few dividends dropped in so that is always nice.

Had a discussion with my boss and managed to get more vacation days so I'm very pleased about that. I keep looking at properties in France but getting building permission appears to be less easy and one needs to speak with the council to find out about local regulations on the topic.

For the previous summary please visit Summary of January 2022 and here you can see my stock portfolio as it is.

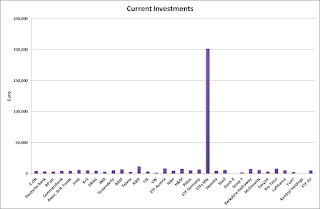

The total invested value is now at: 268,137 €. Monthly investments made in ETF Mix and ETF EU.

The value of the portfolio is today: 357,279 € and I have 1,826 € in cash on my broker accounts. I have realised gains of 2,498 € and unrealised of 89,142 € (25%) which is not good enough but it is improving. My ETFs are now up at a value of 62% of my portfolio.

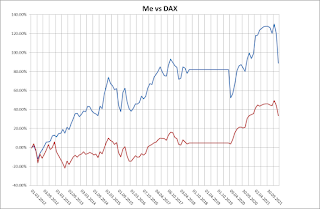

DAX is now down at 13,095 points which means that it has decreased by -14.2% since the previous summary and my own portfolio has decreased by -10.7% in the same time period.

Conclusion: It's a bad period in the world at the moment which of course have led to some opportunities that I for moral reasons are refusing to grab.

2 comments:

Hi, still didn´t get why your are investing frechn immo assets ?

I used to live in France back in the days and I loved it! The weather the food, the people. I simply loved all of it. So when I'm making my FIRE then I'm thinking about buying a property in the South of France to live because I will for sure to remain in the UK and the interest of sitting in Sweden is also not that high. So France will be a good country to retire in.

Post a Comment