|

| Summary of April 2022 |

Plenty has happened since my last report which is also part of the reason why I missed one in March. Russia took the wrong decision and invaded Ukraine and are learning the hard way how difficult it is to invade a democratic country in the world and I hope that China will realise in other areas of the world that they need to take a step back.

Received some very nice dividends from Rio Tinto and Skanska.

I've managed to travel to Australia to surprise my brother on his 50ths birthday and then back home to Sweden for Easter holiday. My brother was very pleased to see my in Australia but my gosh, is it a loooong trip to make for only 5 effective days in Australia. Prices have also gone up by 2 to 3x since I last went there in February 2020. It was well worth it and I was the only one that could make the journey so I did.

My current boss have decided to step down from the company which means I will get a new boss! This is very exciting for me while plenty of people in the company are scared about the transition and change but I am not. I'm loving it! We all have our benefits and faults and I'm looking forward to experiencing those of my new boss in the near future. This will either accelerate or decelerate my departure from the company. I hope it will be a female since in my opinion they are better bosses in todays environment and more of them are needed to break up the "old dog" structures.

Work have also started on our summer house in Sweden and in the coming months we can look forward to have yet another house on the property which we can either rent out or use when plenty of us are there. It is very good progress and I'm very pleased!

For the previous summary please visit Summary of February 2022 and here you can see my stock portfolio as it is.

The total invested value is now at: 289,980 €. Monthly investments made in ETF Mix, ETF EU, Yum, Restaurant Brands, Netflix, EasyJet and I divested Shell.

The value of the portfolio is today: 393,422 € and I have 6,269 € in cash on my broker accounts. I have realised gains of 5,538 € and unrealised of 103,442 € (26%) which is not good enough but it is improving. My ETFs are now up at a value of 62% of my portfolio.

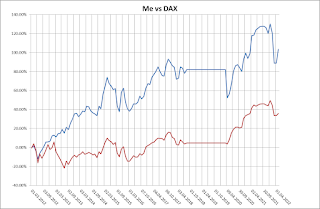

DAX is now up at 14,098 points which means that it has increased by 7.7% since the previous summary and my own portfolio has only increased by 2.1% in the same time period.

Conclusion: DAX have had a strong wind in its back while I pushed in some serious amount of money. This usually creates a setback especially when I'm trying to capture falling knives such as Netflix. I do however still believe that in the long run it will all be good. I've been flying plenty with EasyJet lately and the flights are full so hopefully also the earnings will start to reflect this.