|

| Summary of December 2022 and partially January 2023 |

It will take a while before I stop this however war is still ongoing! The yearly inflation for many countries were in the double digits region. House prices are somewhat dropping, people try to avoid large energy bills. The pound sterling that looked good for a little while have now dropped down to the area it has been since pretty much BREXIT took place. Governmental employees keep going out on strikes and in generally few wants to come into the office to work.

I had a lovely Christmas market event in Berlin even though fewer than usual managed to turn up. Next year I hope it will improve! I had two wonderful weeks in Sweden and of course I took on the role of Santa Claus. My youngest nephew was slightly worried and had to hold the hand of his daddy (my brother) to approach me. I run a strict scheme and everyone must shake my hand before I let go of the gift. I celebrated New Years Eve with a couple of my buddies with lovely food and games.

Plenty of things on the agenda in the company this year. I've started to push as much as I can because I will not walk away with an abundance of lose threads and just leave the employees hanging. I hope I will succeed with all the targets that I've put on myself in the months that I have left.

For the previous summary please visit Summary of November 2022 and here you can see my stock portfolio as it is.

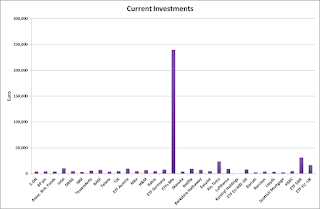

The total invested value is now at: 332,180 €. Monthly investments made in ETF Mix with fresh cash and then I sold Restaurant brands, Yum, Stock Y, McDonalds, RWE, VW, DB, CZB, K+S and instead I bought Barratt, Barclays, Lloyds, HSBC, Scottish Mortgage, Intel and ETF SWE.

The value of the portfolio is today: 455,859 € and I have 1,402 € in cash on my broker accounts. I have realised gains of 6,471 € and unrealised of 123,679 € (27%) which is not good enough. My ETFs are now up at a value of 69% of my portfolio.

DAX is now up to 15,034 points which means that it has increased by 3.5% since the previous summary and my own portfolio has only increased by 2.3% in the same time period.

Conclusion: DAX had another good month and overall the year for DAX did not turn out that bad. I took some advantage of currency differences during the month but less so than what I would have liked. There will be no report for the end of January and the next one will not be until the end of February when I have hopefully handed in my letter of resignation.

No comments:

Post a Comment