|

| Summary of April 2023 |

Ukraine is on an offense now which is great news! Pity that lives are still lost every day and so close to us. When I was back home in Sweden for a week to sort out a van I managed to go to Walpurgis night (Valborgsmassoafton), which I've not done for the last 20+ years. The deaconess held a lovely speech about the Ukrainians struggle and how many had arrived to Sweden and once their region was liberated again they went back home. They are strong and they will persevere!

The reason for me being back home as I also wrote in a pretty long response in the Summary of March 2023 was to buy a van and to drive it back to the UK so that I can bring back my stuff and during the summer convert it into a functional camping van for my journey towards the south of Europe. I hope I can start it in August but it might be delayed. On my way south I'm hoping to visit friends of mine (so I can shower and fill up with fresh water also!) since afterwards they will have to come and see me if they want to due to my future travelling budget will be very limited. Good news are property prices have started to drop all over Europe so it's a pretty good moment to do what I'm planning to do next. People are feeling the squeeze of the increased interest rates, even though the job market, at least in the UK, is still very strong. Massive droughts in the south of Europe, Spain in particular, which makes living on rainwater all the more interesting if it can be accomplished.

The work project I've been pushing has gone very well and I've created a lot of connections in the field which is excellent and I'm feeling content walking away. My colleagues have not yet understood/accepted that I'm leaving which is a bit funny. They want to hold me on as a consultant which I might accept to continue to help them a bit also in the future. This will require me to set up a company in Sweden which I will then not take out any salary from but only "dividends" on the profits if there are any. I doubt the consultancy agreement will run for more than one year and after that they should be able to stand on their own two feet also without me.

My final salary will arrive in 17 days and then I need to file a P85 to HMRC due to leaving the UK. I hope this will give me back a bit of money since I'm receiving only two salaries in the new UK tax year and my tax rate has been calculated on me receiving the salary for a full year. I also have some remaining holidays, 10 or so, which I will also get paid out as salary.

I know that all of you are highly clever individuals but I just want to make it as a crystal clear statement. That I will now do F.I.R.E is NOT because I've been a great investor. I truly have not been and I've done so many mistakes that's costed me dearly. It is purely down to low cost living, acceptable salary and that I'm a great saver on the stock market. I wish I would have been a great investor with 20% increase each year but I'm not and I have not so maybe there is something to take onboard from this but I leave that with you.

For the previous summary please visit Summary of March 2023.

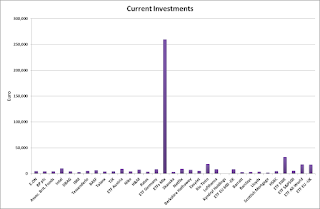

The total invested value is now at: 362,717 €. A minor monthly investment was made in ETF Mix with fresh cash and more substantial into ETF S&P500 and ETF All-World from Vanguard.

The value of the portfolio is today: 494,606 € and I have 2,833 € in cash on my broker accounts. I have realised gains of 6,471 € and unrealised of 131,889 € (27%) which is not good enough. My ETFs are now up at a value of 73% of my portfolio.

DAX is now up to 15,914 points which means that it has increased by 1.8% since the previous summary and my own portfolio has decreased by -1.7% in the same time period.

Conclusion: DAX once again had a good month while I did not. Today it hardly makes any sense to compare myself to DAX since my portfolio is far away from DAX but it's where I started so I keep it up as an historical reminder. Next report will be made from Sweden and will probably not be until in end of June. I'm hopefully then fully active with the camping van conversion and there will for sure have been no more money added to the portfolio.