The operating or trading report as they call it that they arrived with was a one and a half page report so the front page above is more or less all that were in it. Beautiful! I love to see when a company are cutting expenses in this way since that means to me that they are seriously going after costs cutting and are not only talking about it. The market responded with circulation around the +-0.5% during the day of publication.

Friday, 31 October 2014

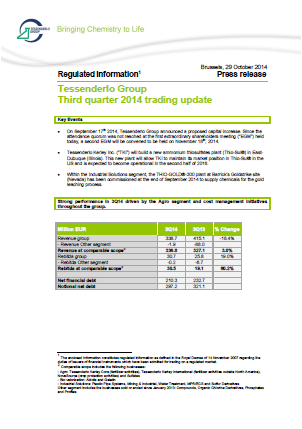

Tessenderlo operating report Q3 2014

The operating or trading report as they call it that they arrived with was a one and a half page report so the front page above is more or less all that were in it. Beautiful! I love to see when a company are cutting expenses in this way since that means to me that they are seriously going after costs cutting and are not only talking about it. The market responded with circulation around the +-0.5% during the day of publication.

Thursday, 30 October 2014

Wednesday, 29 October 2014

Tuesday, 28 October 2014

How to protect yourself from dodgy bookkeeping in companies?

I have now had four companies that arrive with serious adjustments of their balance sheets. Each time what I thought was value in these company turned out to be air castles that could be swept away with a bit of wind or burnt in the campfire for that matter.

The first ones were my two banks Deutsche Bank and Commerzbank that needed to down adjust some assets. In both these cases the damage has been small for me since because the stock market had one way or the other already accounted for the decreases in book value and also for me it has been less dramatic since I did not really buy them due to the P/B value but I bought them due to that generally all banks were, valuation wise, completely pushed down.

Monday, 27 October 2014

Sunday, 26 October 2014

Saturday, 25 October 2014

Analysis of Royal Mail

Company: the Royal Mail PLC

ISIN GB00BDVZYZ77 | WKN A1W5N2

Business: A British mail and parcel delivery company. They are divided into three segments: Royal Mail Group (the collection and delivery of mails and parcels), Parcelforce Worldwide (business express parcel delivery) and the third one is General Logistics Systems (GLS, parcel pickup and delivery in Europe).

Active: Primary focus is the UK and Europe. Mail reach world wide as well as parcel but their core activity is within 27 countries in Europe.

P/E: 17.2

Friday, 24 October 2014

Fighting against private health insurance companies

This will be a very short little text because I have very little time today but there are things that should be mentioned.

That I have very little time at the moment comes from a large order from a customer to my company so that is great news. As always there is then plenty of time pressure and to sell custom made products are on its own already difficult. But still when I have to work hard for 2-3 weeks to make a sale that can pay my salary for a bit over 3 months then it is worth it to work nights and weekends.

In the last three months I have been fighting against my private health insurance company since they all of a sudden arrived from the blue and wanted to have an extra payment from me in the size of 213 €. This extra payment that they want to have from me was due to four months back in 2011.

Thursday, 23 October 2014

Strong progress means show and tell

As I mentioned in Change of plans the new project was to bring all the analysed companies into one large document.

I have still not finished my work with the All company analysis list but I find that it starts to be pretty ok so I have opened it up for all of you to look at.

The concept of the list is still the same with a formula that calculates the motivated price to earnings value based on mainly their yearly revenue growth rate. When you look at the list then please, please, please be very observant regarding the date of the analysis. In many cases there can be one or even more annual reports in between which makes the current calculated P/E values etc slightly wrong. The good part of this is that you can then only request a new analysis of me and I will do it as soon as I find the time.

Wednesday, 22 October 2014

IBM report Q3 2014

The share price dropped with almost -10% for IBM upon, not due the release of their Q3 report, but based on their webcast. Still now, when I am writing this, the Q3 report is still not available online and I have therefore gone to the SEC data base to extract the number. This makes me very annoyed! The quick drop in the share price due to earnings not living up to the analysts expectations I can live with but to not publish the report online when everything else is already out just makes me mad!

Tuesday, 21 October 2014

The boredom of silent periods

Even though I am a huge supporter of yearly reports instead of quarter reports I tend to find it very boring when there are no news arriving from my companies as it is right now. Well, Intel arrived with their report so that was the starting point of the other reports to arrive but still. I was starting to get bored.

Is it then good or bad when no news are heard concerning the companies?

Monday, 20 October 2014

Analysis of Piramal

Company: Piramal

ISIN INE140A01024 | A0DQEJ

Business: An Indian mainly pharmaceutical company that before the 1980s was a textile company. They stand on four pillars today: Piramal Enterprises with (piramal healthcare, piramal life sciences, piramal capital, and the decision resources group), Piramal Glass (creating all kind of good looking glass containers for perfumes etc.), Piramal Realty (they have started to step into real estate) anf finally Piramal Foundation (social project to improve life in India).

Active: Their self developed pharmaceuticals are being sold in over 100 countries which gives them world wide presence.

P/E: -26.8

Comment: Approximately once per year I go to India for business and I was just not invited for going there in March. This caused me to take a look at some of the companies in Indian and from the screener Piramal looked very interesting. The result was not as interesting though.... The common shares have no voting power and the voting power shares seem to be held very tightly by the Piramal family. I almost get the feeling that when they get bored they start to invest in new things and maybe one should look more upon the Piramal Group as an investment company than anything else.

Sunday, 19 October 2014

Change of plans

As the picture so nicely puts it. Sleeping is overrated. I always find it horrible when I sit down and calculate how much of my life that I am just sleeping away. Sure, some people live a more exciting life when they sleep than reality so no wonder they want to sleep 10 to 12 hours per day but for a person like me that never remember any dreams those five to six and half hours are just a drag.

I know that my body needs it... at least as things are today but to find a more efficient solution would be a great invention that I would fully support.

Anyway, what are then those change of plans... well, it simply boils down to this. I have decided that I need to put not only the kicked out companies on a list but all of them. I will still keep the documents separated as I have them now and I will just add one more list that is not called kicked out but it will be the one file to serve them all, one file to rule them all and one file to well... take a look at every now and then. It will then also become easier to see if a company will get interesting again and I can look at that list and be less dependent on people informing me and giving me a heads up when a company starts to turn interesting.

Saturday, 18 October 2014

Analysis of Kardex

Company: Kardex

ISIN CH0100837282 | WKN A0RMWK

Business: A Swiss storage and distribution company. The company have two business units: The first one is Kardexremstar (with Carousel and lift systems, Office solutions and Warehouse solutions ) and secondly Kardexmlog (with Storage and retrieval systems, Conveyor systems, Turnkey systems solutions and Material flow systems).

Active: They are present in over 30 countries which they claim to be world wide.

P/E: 8.0

Friday, 17 October 2014

Extra stock bought October 2014: BASF

Due to the current silliness of the market a lot of nice opportunities have turned up and if a DAX company starts to trade too cheaply, which many of them do right now, then I would be silly not to try to buy it.

For that reason I managed to bring up some extra money and I bought 31 shares in BASF at a total cost of 2012.05 € including fees or better put around 64.90 € per share. I think I will have to live yet another month on air and love, but that will not hurt me as long as it is not every month...

Thursday, 16 October 2014

Wednesday, 15 October 2014

Analysis of Swiss Re

Company: Swiss Re

ISIN CH0126881561 | WKN A1H81M

Business: A Swiss reinsurance company. They have three business units: Reinsurance (with Property & Casualty and Life & Health), Corporate Solutions (which concerns risk management and financing needs of corporations) and finally Admin Re (consultancy for insurance companies).

Active: Globally with presence on each continent reinsuring companies with global presence themselves.

P/E: 6.4

Tuesday, 14 October 2014

PIF C: October 2014

For the previous report with company composition please see Personalized Index Fund C: July 2014. Back then things were looking very good for this mechanical fund and in only two months it had manaed to increase 2% more than DAX.

Today PIF C is standing with the trousers down and it has during the last quarter decreased by -9% and are now at an equal level with DAX at -6% since the start of round two.

I am so glad that I am running this experiment before I have to take the decision to put a large part of my money into a "fund". Beating index is tough!

Monday, 13 October 2014

Analysis of Ascopiave

Company: Ascopiave

ISIN IT0004093263 | WKN A0LF39

Business: An Italian distributor and seller of natural gas. They are divided into three activities: Distribution (with 8,600 km of pipelines), Gas Sales (to 830,000 clients) and finally Other Services (generation and sale of heat and electricity).

Active: Italy only

P/E: 10.4

Sunday, 12 October 2014

The autumn crash of the stock market

In just a few days my own portfolio has dropped by over -10% and I am sure that it is very similar for you guys. Are you worried about your investment?

Saturday, 11 October 2014

PIF B: October 2014

Well, well, well and there I was so proud that my Personalized Index Fund B: July 2014 had managed to beat DAX with 1% during the start of year two. No need to mention that of course year one was a big loss.

As can be seen in the graph above PIF B is down at the same development as DAX with -6% since the start. The difference lies in the difference. DAX dropped -7% during the quarter and PIF B dropped a total -8%. The disturbing thing here is that theoretically according to contrarian investing the beaten down companies with low P/E and P/B loose less in value when the stock market drops because they are already so pushed down.

Since I do not see that behavior here I wonder if it is temporary fluctuation or if the theory is wrong. I will wait and see but I am a bit annoyed.

Friday, 10 October 2014

Analysis of Amer Sports 2014

Company: Amer Sports

ISIN FI0009000285 | WKN 870547

Business: A Finnish sports goods company. They produce high technological sports equipment, footwear, apparel and accessories. They are divided into three business segments: Winter and Outdoor, Ball Sports and Fitness.

They have several well known brands, such as: Salomon (mainly shoes and skiis), Wilson (ball sports equipment), Atomic (ski equipment), Nikita (female street fashion brand), Mavic (bicycle and bicycle equipment), Bonfire (snowboard equipment), DeMarini (baseball bats and baseball equipment), Precor (fitness equipment), Suunto (sports precision equipment ) and Arc'teryx (outdoor cloth and equipment).

Active: Their own sales network is now established in 34 countries.

P/E: 20.2

Thursday, 9 October 2014

Fighting the Finanzamt II and other matters

Previously I wrote that I was fighting against the German IRS regarding my tax deductions and you can read about it in the article fighting the Finanzamt (the German IRS). There I mention that in my final letter to them I demanded to receive the reason for each deduction that they decided to refuse.

I have now the answer back from them and it was, as it also should be, complete acceptance of every deduction. Once the decision has been made they directly pay out the money and it has even ended up on my bank account which meant that it was directly shifted to my stock broker account.

Wednesday, 8 October 2014

PIF A: October 2014

It is indeed sad to see how the PIF A is yet again failing to beat index. Is there no end to the embarrassment for PIF A of trying to beat index and failing? Each passing month of failure means that index funding is the correct way to go and I am glad I always try to give that as advice to people.

DAX has since July dropped with -7.5% while PIF A has dropped down with -9.6%. DAX won yet another round big time!

For the previous article please see Personalized Index Fund A: July 2014, there is a better explanation for the composition.

Tuesday, 7 October 2014

Analysis of Südzucker 2014

Company: Südzucker

ISIN DE0007297004 | WKN 729700

Business: A German agricultural company. Their main focus is like the name as well as the logo implies sugar (=zucker in German). They are divided into four segments: Sugar (the sugar is refined and sold under the names of Südzucker & Agrana), Special products (Bene which are making functional ingredients for food and Freiberger with frozen pizza and pasta dishes), CropEnergies (the production of bioethanol) and finally Fruit (once again Agrana and Austria juice). Agrana which is to around 49.6% owned by Südzucker and it has previously been analysed please see analysis of Agrana.

Active: Main market is Europe especially with their main business sugar. Via Agrana they are present on all five continents.

P/E: 8.4

Subscribe to:

Comments (Atom)