The report from Intel arrived last week and the stock market did not accept it with much enjoyment which is mainly due to a slightly grimmer outlook than what probably analysts expected. Intel is not really showing a significant boost in their business due to the acquisition of Altera but are more bringing up the costs and how that will make 2016 (full year!) look... bad. The share price dropped with around -10% in the days following the report.

To view the report in full please click here and for my previous summary please see the Intel report Q3 2015 and to find out more concerning Intel then please go to analysis of Intel 2015 (a new one will arrive most likely tomorrow).

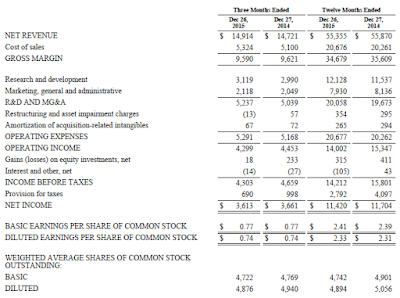

If we take a look at the financial statement below then we see that the revenue compared to 2014 is pretty much flat, the cost of sales increased a little and they have also increased their research spendings again. The net earnings was down by almost -10% which is a lot! They did however pay much less taxes compared to 2014 so the result after taxes was only down by -2.5%. On top of this they have kept buying back shares which meant that earnings per share increased compared to in 2014. They have still not included the effects from the Altera acquisition so that will be seen in the next Q1 report for 2016.

Conclusion: Intel is currently keeping their ground in terms of revenue. As I have mentioned before if a company makes over 10 billion USD is earnings on a 55 billion USD revenue then I am not scared of keeping them for the long run even if they generate only that for a couple of year with hard competition and lost market opportunities because I expect them to grind down the competitors over time either via acquisitions or via R&D to find even better solutions. I will remain as a shareholder in Intel.

No comments:

Post a Comment