Here follows the summary for August 2013. The month was tough once again and this time due to three reasons: I still have half salary, I went on vacation (I still managed to keep up the blog) and there was a wedding also this month so unfortunately I did not manage to transfer any money to my stock deposit. This month I hope that by going back to a more austere living that I will be able to save some money. I hate not being able to pay myself first of all in the beginning of the month!

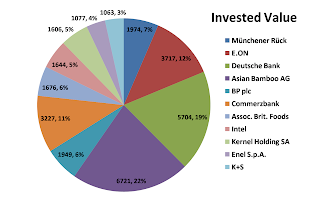

In the above pie chart which represents the money I have invested in stocks only a small change has occurred and that was the addition of K+S after their dramatic drop. I bought it slightly too early but a contrarian stock on DAX with high yield was just to tempting for me and I bought it directly when it dropped. The total invested value is now up at 30358 € which I am pretty proud of since I only started 18 months ago.

The current value of the portfolio is now down to 24936 € (-18%) due to a big drop with MüRe was well as Asian Bamboo after their poor report in the beginning of August. The drop in MüRe has been more sneaking up on me and I have hardly realised that it has decreased as much as it has from last month. Oh, and I am less proud of the current value on my stock portfolio.

The above chart is showing no big change since both DAX and I went down from last month. DAX went down by -2% and my contrarian stocks decreased by -3.6%. Overall DAX is up by almost 19% since I started to compare myself with it. What starts to concern me is that I am now more or less half way into the project and I do honestly not see that Asian Bamboo as well as Commerzbank will manage to recover during the next 18 months and only if I am extremely lucky will Asian Bamboo start to turn at that point and Commerzbank will maybe be back at +-0% but I doubt it will be better than that.

Either way I still have full confidence in all my stocks and have just started to realise that my time line was simply too ambitious with only three years. I will have to see how I do in the end... if I extend the time or if I sell off everything and buy index funds.

For the full portfolio report please go here and if you have suggestions for stocks that I should analyse then please go here. If you do write a comment then it will not appear directly because I always screen it first and as soon as I have done that it will be published.

No comments:

Post a Comment