The summary for September is, stock portfolio wise, not much better then what it was in August 2013. The month was privately less tough which was due to that I went back to a more normal life even though I am still on half salary but now I have adjusted fully.

I managed to transfer a crazy amount of money to my stock deposit (1739 €) which can be read about here. So I did at least manage to pay myself first this time!

In the above pie chart which represents the money I have invested in stocks only a small change has occurred and that was the addition of DBAG. It is a solid investment company and I am pretty certain that the German industry will continue to go strong for the next couple of years. The total invested value is now up at 31,369 €.

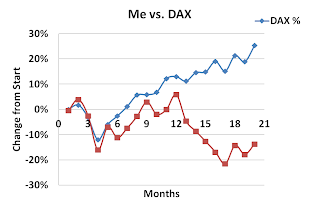

The current value of the portfolio is down to 27,069 € (-14% from the start of this adventure) which comes mainly from the overall big decreases of Asian Bamboo and Commerzbank. I still believe in both shares and are not concerned. The CEO and founder was in end of July tanking 0.5% of the total shares in Asian Bamboo so also he seems to still believe in his own company. Even though I improved this month with 4.1% from last month I still got whopped by DAX.

I have still not lost confidence in any of the stocks that I own.

For the full portfolio report please go here and if you have suggestions for stocks that I should analyse then please go here. If you do write a comment then it will not appear directly because I always screen it first and as soon as I have done that it will be published.

No comments:

Post a Comment