|

| Summary August / September 2023 |

War is still going on between a dictator and a democracy in Europe. Horrible!

I would like to apologise for that I have had to combine two months in this report. I was about to blame it on that I've been busy, and I have, but still...

During the two months the sun was shining so I've been very active with my van conversion. I additionally painted my parents house (with their help of course) and my consultancy company got up and running so I've worked with my old company and was even sent for a week to the USA represent them in an activity.

Van conversion - last time I had insulated, moisture barrier and laid out the floor. Now I have done the same with the walls, the doors and the ceiling. I've put in a kitchen area with a sink, I have fresh and grey water tanks and a foot pump for the water. I've put in my bed, I needed to build a frame and storage space underneath it because I lost so much surface with the bed. I've put in a table to eat at and to work at. I've put in a mirror to gain more light and make the space look bigger. I've put in infrared heating which I think is a lovely new way to heat up small spaces. I've put in fire alarm and carbon monoxide alarm which is less required since I will not use gas but still... The batteries (2x24V in serie to give 48V output) are in and connected to the inverter, the solar panels (2x24V in serie to give 48V output) are connected to the MPPT/Inverter, the AC current and the home fuse box is in and after a bit of a trial and error journey are now also working and are releasing as it should and my three AC outlets works perfectly fine. I still have three things running on DC which is my ceiling fan, and two lamps. All these are also working fine. One big issue though.... the inverter that I bought was for a home and I had failed to realise that it needed a substantial voltage from the solar panels to charge the batteries. Once I realised the mistake I've also realised that I cannot increase the solar panels to reach the needed voltage so I've been forced to order another inverter which will arrive shortly. This will however require me to parallel connect my batteries instead of having them in serie. What's left? Well, I need to put in a lot more storage space, I need to put in media, swap out the inverter so those freaking batteries will get charged, I need to put in a toilet, fridge, induction cooker. These are hopefully the big ticket items left. I also need to do a MOT on the van, which I should do during October.

Painting my parents house was not really fun but it had to be done and I'm happy that I am around and could help them out with that! At the absolutely worst location, three panels needed to be changed out so that was a bit of a drag and though I'm not afraid of depths I must admit that my legs started shaking a bit when standing high up on the ladder and needing to lean out to hammer them stuck in place. Anyway, now it is done and will hopefully last for 7-10 years.

In the end of August my company was finally up and running. I got a bit upset with the Swedish tax office because they demanded me to show my private economy when the company requested F-skattesedel and VAT register. To my knowledge an AB is it's own legal person and in this situation the Swedish tax office takes the decision to NOT consider it as such due to few owners of the AB. I provided them with the requested papers and I could finally sign the contract with my old company. This led to me going over to the USA on assignment for a week and additional work being interviewed by journalists, speaking to potential customers etc. This additionally delayed things with my van but on the other hand I could write an invoice to them which I did now in the end of September.

I do enjoy living in my summerhouse and I've started to think more and more about delaying my departure until early next year. Both due to that I'm running so late, it gives me more time to test it out before heading to the south, and Christmas is not far away and I definitely wants to celebrate that with my family here in Sweden. It feels good to have been able to join in on all the Swedish events this year that I haven't been able to for 20+ years such as midsummer, crayfish party, birthdays etc.

For the previous summary please visit Summary of July 2023.

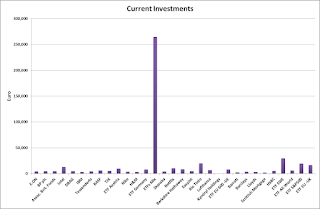

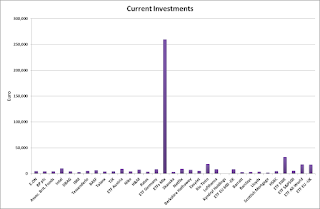

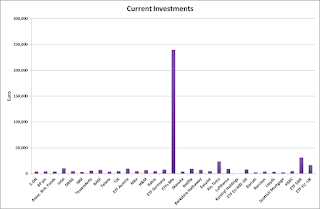

The total invested value is now at: 353,601 €. No investments were made and no investments were sold.

The value of the portfolio is today: 491,025 € and I have 2,284 € in cash on my broker accounts. I have realised gains of 7,487 € and unrealised of 137,424 € (28%) which is not good enough. My ETFs are now up at a value of 74% of my portfolio.

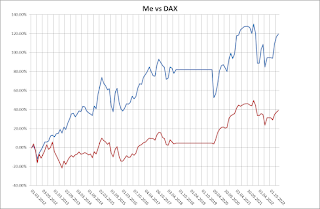

DAX is now down at 15,387 points which means that it has decreased by -3.7% since the previous summary and my own portfolio has decreased by -2.0% in the same time period.

Conclusion: The stock market went down for a while in August and have since then now started to recover slightly during September. Due to some dividend payments I'm very close to take some money out from my German stock broker but at this point in time I do not yet need it so I leave it for now.