The operating or trading report as they call it that they arrived with was a one and a half page report so the front page above is more or less all that were in it. Beautiful! I love to see when a company are cutting expenses in this way since that means to me that they are seriously going after costs cutting and are not only talking about it. The market responded with circulation around the +-0.5% during the day of publication.

If you want to flip over the pages in this report then please go here from where I have also gotten the little material that I present.

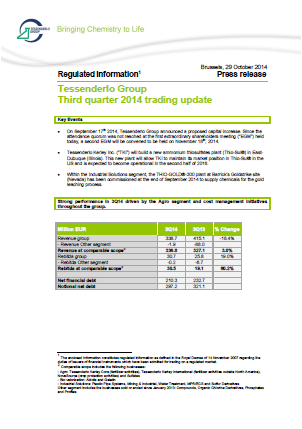

Below is the financial statement that they arrived with and from my point of view the report was not good. I want to see revenue and I want to see profit. EBIT, EBITDA or their favorite here REBITDA (EBITDA with the removal of nonrecurring items... was NEBITDA already taken I wonder...) are all fancy words that are often used to paint a picture that is better looking than reality. So from my point of view their revenue is down by over -18% compared to 2013 and they have managed to divest some segments that carried losses in Q3 2013. I do like that they have significantly managed to decrease the debt by almost 10%.

Other things mentioned in the report were that they failed to make a vote concerning the capital increase of 150 to 200 million €. This is bad news to me since that means that besides from Picanol the rest of the larger shareholders did either not manage to meet up or they could not be bothered to meet up. Then again, I never got an invitation to this meeting so when they exclude big shareholders like me then no wonder things will not happen as they want.

Personally I agree with that more money should be brought in and I were then planning to step in with the second part of the investment. I thought it would happen in the beginning of November but now by the look of things it will take longer.

Of their three segments Agro has been doing very well and the Bio-valorization and the Industrial solutions have had a much worse quarter. That they cay that Agro has been doing well I like to hear since this then hopefully means that K+S have also had a good quarter (which we will find out on the 13th of November).

Conclusion: Tessenderlo is still turning around and even without a capital injection from the shareholders they have managed to decrease the debt. I will of course keep my shares and are expecting to increase my holding even further in the future.

To find out more about Tessenderlo please see analysis of Tessenderlo.

2 comments:

To raise capital in Belgium you need 50% of all shareholders attending the meeting. It was expected that they did not meet this requirement. Like you said, Picanol is the only big shareholder around. The second meeting doesn't have this obligation, so normaly the capital increase will be voted then.

And it's indeed a big boat to turn around. They are investing in their best division. Let's see if they can turn around the others too.

Hi Garry,

Yeah I suspected that they directly arranged two meetings after one another to get around this problem. It means that a major minority owner can pretty much always get their will thru on the second meeting and can in that way completely control the company.

In many cases that would worry me but in this situation I made the investment based on Luc Tack so I like that he can so easily control it. I guess he would not have stepped in otherwise anyway.

Post a Comment