Recently Kernel arrived with their annual report and it was not so nice. The last year was complicated for them due to several reasons and it is also reflected in the report. I am late on the ball here due to them changing the date for the publication and therefore I can only say that by the look of things the market found the report to be ok but how many %-age it went up that day I can not tell.

The report in full can be found here and all material is taken from it. For the last quarter report please see Kernel report Q3 2014 and for the last full year report please see Kernel annual report 2013.

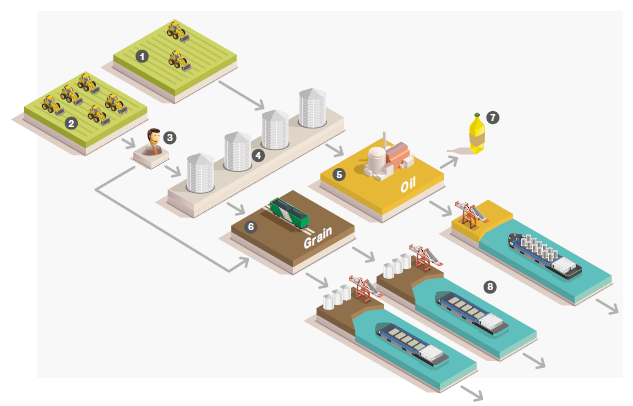

There was a graphical presentation of the Kernel business model that I very much liked and it can be seen below. So besides from having their own 380,000 ha of land and farmers (1) they also buy products (3) from external farmers (2). This then goes to silos for storage and drying (4). This step is sometimes crucial since the price often based on the protein content and the more water there is still in it the lower the price on gets in the end. The grain is then directly transported (6) to the harbor (8) from the silos and for the sunflower seeds they are send to their pressing units (5) that then produce bottled sunflower oil (7) that are sold under three brand names and they make the bulk oil that are shipped out via their harbor (8) into the world which is mainly to India at the moment.

How are then the finances one wonders? As can be seen below it was a bad year for us. The revenue dropped with around -15% and for the first time ever the farming business made a minus. This was not accepted and the boss for that department was directly out since there had been too many internal issues. In the farming business there will always be weather based issues and those must also be accepted but that was not the case here. Even though Kernel made a loss of 101 million USD this year the management is confident enough to offer a dividend in the size of 0.25 USD. It was a long time since they started talking about paying dividends so I will believe it when I see it on my account.

The assets have decreased as well as the liabilities. unfortunately have the assets decreased more... They also bought back some shares during this period of extreme low share valuation.

Conclusion: Kernel had a bad year and their main problem has been the sunflower oil. They are simply too dependent on that for making good results. It therefore pleases me to see the development they have made with grain which I hope will one day leverage any potential issues with the sunflower oil. Since I bought Kernel I have completely gone over to using sunflower oil in my cooking. I find it superior to all others due to its neutral flavour. To get something similar with olive oil one have to pay 10 € per litre. I will keep my shares in Kernel since this is a long term commitment.

If you want to find out more about Kernel then please see analysis of Kernel 2013.

No comments:

Post a Comment