Here comes the brief summary of the Q1 2015 report Coba, which is the second largest bank of Germany that back in 208/2009 failed one step more than DB and had to get capital from the German taxpayers to survive. This they often repaid in kindness by pushing out their bad assets to the German population, often to elderly people, that trusted in that the bank they had been customers with for 30+ years would not cheat them. How wrong they were and shame on Coba and all the other banks for that matter.

For the report in full then please click here and for the previous brief summary then please visit Coba annual report 2014 and to find out more about Commerzbank then please go to analysis of Coba 2015.

The managers have been trying to push up the share price by saying that they will pay dividends next year. Hmm... first I want to see the final year report for 2015 before I will allow that to happen. They appeared with this offer at the same time as they made a selective share issuing for institutional investors. They do not only treat their customers bad but also their small shareholders.

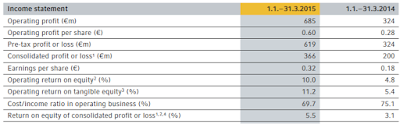

Let us take a look at their key figures, as they call it. Operating profit increased which is good and the earnings per share is also good. Never forget that it is a bank though Q1 2014 they had a 0.18 € "profit" in Q1 only and yet for the full year we ended up with a total "profit" of 0.23 € so it all unfortunately boils down to them writing down or up assets and that tend to happen in Q4. They have however managed to increase their C/I from 75 to 70% and this is good! Now they just need to bring it down to 50 to 55% and then they could classify as being a profitable bank.

If we take a closer look at the income statement then there is only one thing that I like and that is that by the look of it the bleeding has stopped. The interest income did more or less not decrease at all when comparing quarter to quarter and I hope that we will even see an increase here in the future. The number that pokes me in the eye is the Operating Expenses that increased with 14.2% to 1.9 billion euro. It did not come from personnel costs but it comes from that Administrations costs have blown up by more than 36%! No explanation for why they have smacked on a bit more than 200 million on administrative expenses. I guess that was such an insignificant figure anyway that no purpose to explain that... I mean it only correspond to 50% of the quarter profit! So I had to call up the investor relations to find out more regarding this and the answer I received were initially that a colleague would call me back and then I got a call back and a very clear answer which pleased me (even though it only explains a bit of it but still) 167 million € comes from a European bank levy (so a bank tax) that they have to book in Q1 and it should be the full amount for the year so in the next quarters the costs should drop down by an equal amount until the value will be completely fixed and then a correction will appear in Q4 which will hopefully be in the good direction for us shareholders.

Conclusion: Coba are still trying to make themselves look good and their latest flirting with the institutional investors with the promise of a dividend next year did at least not push up the share price so I guess no one really cared. I will continue to be a grumpy shareholder even though I was very pleased with the response and reply that I received from my investor relation in Coba!

Let us take a look at their key figures, as they call it. Operating profit increased which is good and the earnings per share is also good. Never forget that it is a bank though Q1 2014 they had a 0.18 € "profit" in Q1 only and yet for the full year we ended up with a total "profit" of 0.23 € so it all unfortunately boils down to them writing down or up assets and that tend to happen in Q4. They have however managed to increase their C/I from 75 to 70% and this is good! Now they just need to bring it down to 50 to 55% and then they could classify as being a profitable bank.

If we take a closer look at the income statement then there is only one thing that I like and that is that by the look of it the bleeding has stopped. The interest income did more or less not decrease at all when comparing quarter to quarter and I hope that we will even see an increase here in the future. The number that pokes me in the eye is the Operating Expenses that increased with 14.2% to 1.9 billion euro. It did not come from personnel costs but it comes from that Administrations costs have blown up by more than 36%! No explanation for why they have smacked on a bit more than 200 million on administrative expenses. I guess that was such an insignificant figure anyway that no purpose to explain that... I mean it only correspond to 50% of the quarter profit! So I had to call up the investor relations to find out more regarding this and the answer I received were initially that a colleague would call me back and then I got a call back and a very clear answer which pleased me (even though it only explains a bit of it but still) 167 million € comes from a European bank levy (so a bank tax) that they have to book in Q1 and it should be the full amount for the year so in the next quarters the costs should drop down by an equal amount until the value will be completely fixed and then a correction will appear in Q4 which will hopefully be in the good direction for us shareholders.

Conclusion: Coba are still trying to make themselves look good and their latest flirting with the institutional investors with the promise of a dividend next year did at least not push up the share price so I guess no one really cared. I will continue to be a grumpy shareholder even though I was very pleased with the response and reply that I received from my investor relation in Coba!

No comments:

Post a Comment