Once again I have shown my skill in catching falling daggers. The report was very poorly accepted by the market and the share price decreased significantly on the day of the release. The share price of RWE has gone from above 30 € down to around 16 € and I ended up "catching" the knife in the middle so I am now around -30% on this investment. Bad done Fredrik!

To read the report in full please go here, to see the previous summary then click on RWE report Q1 2015 and to see the previous analysis of RWE 2015 then please click on that link.

The struggle continue for RWE. They managed to divert the first obstacle coming from the German politicians but they are still only treading water and Q1 which I did not like was followed by Q2 being even worse. The profit that were reported in Q1 was to a large extent consumed in the Q2 report. The CEO do however write a sentence saying that "... appearance can be deceptive.". I especially like the can word since that means that it can also not be deceptive and then actually be a representation of reality.

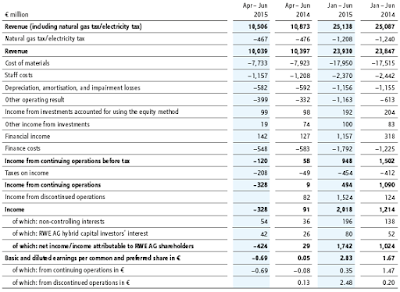

The financial statement below is pretty close to a disaster. They managed to keep up the revenue so that is good but then there are simply too many costs appearing. If we look back on the previous quarter then we could see RWE having 3.52 € EPS which is now for the half year at 2.83 € and what is even worse is that 0.35 € EPS comes from continuing operations and the remaining 2.48 € comes from divestment. That does indeed look very bad and the CEO can call it deceptive if he wants but bad it looks.

Conclusion: The painful period continues for RWE and the knife kept falling even deeper. The German politicians and their decisions have not yet been written in stone and lobbying seems to be going on for full. The thoughts in my head are that if you have a product that people will always need and you are sitting in an oligopoly market then you must also be able to make money. There are more aspects to it. I will remain as a shareholder and I will keep thinking on the aspects.

2 comments:

If you make no mistakes then you must be Bernie Madoff...

Learn from them but don't be embarrassed by them. Impressed by some of your recent investing. K+S a fascinating situation and a good call by you. I think Potash Corp are going to have to pay up if they want to take it over!

Hi Chris,

Thanks for your comment! You always have valuable advice and thought that you publish at high speed on your blog! (please check out the Financial Orbit in the blogs that I follow)

Hahaha, Bernard Madoff! Well... that guy should get the Queen award "show must go on" because it is impressive how long he managed to pull it off.

I hope that both of us are correct with Potash Corp. I know you wrote 45 € in one of your articles and I would like to have closer to 50 € before I let go of my few shares. That they arrived with 41 € again in their second offer annoyed me which probably means that other shareholders also got annoyed. An annoyed seller will demand an even higher price in the end... and these poor negotiation skills from Potash Corp. make them look weak in my eyes while they assume they are standing strong and firm with their calculated price.

Post a Comment