Commerzbank joined the club of reporting the third quarter for 2015. The report was well accepted by the market and that the chairman of the board will not extend his contract (he got around one more year of service) was also not something that caused a stir. In one years time they should be able to find a good replacement. I discussed with a colleague that said that he had done a good job... well... I can agree that he has been helpful in getting Commerzbank back on their feet again and he remained loyal and stayed with the bank during the hard times but on the other hand... he was sitting in the board (not is power though) already when the decision was made to take over the Dresdner Bank that has been the biggest cause for almost all the trouble so it is clearly a grey zone situation.

For the report in full then please click here and for the previous brief summary then please visit Coba report Q2 2015 and to find out more about Commerzbank then please go to analysis of Coba 2015.

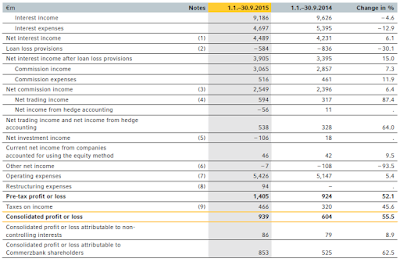

Below you can see the income statement and it still makes me sad to see that their cash cow the interest income has decreased yet again and this time by almost -5%. Happily they have managed to control over their costs so for the half year things are still looking good and much better than what the analysts thought but still I want to see an increase there! Also this year they have now showed three good quarters so we shall see what happens in quarter four. Will they find it necessary to take yet another impairment cost as they have done in the years before? Future will tell.

I would also like to bring the key figures a bit forward as can be seen below and especially the C/I ratio that they have managed to improve a little to 72.3 %. To me this means that they are on their way towards the good direction and they better keep or better yet, improve, that value during Q4. They also mentioned that they have a book value of around 23 € so the P/B is still below 0.5.

Conclusion: Commerzbank arrived with a report that was very well accepted by the market. They kept saying that they will pay dividend next year and most likely it will become 0.2 € per share which means around 2% yield based on current share price. It could be the start of the turnaround that we are now observing and for my point of view it will be very welcomed and my gosh has it taken a long time to happen! I will remain shareholder in Coba and I start to be less grumpy.

No comments:

Post a Comment