The report was very poorly accepted by the market since the share price dropped with around -10% on the day of the release. In a way it is interesting because they mention that they expect the year to become as they forecast which should in my world mean that nothing much should happen upon the release.

To read the report in full please go here, to see the previous summary then click on RWE report Q2 2015 and to see the previous analysis of RWE 2015 then please click on that link.

My fury was direct and intensive when I started reading the report because there they were directly speaking of, the new favourite word, "adjusted" earnings. In this case the adjusted earnings were much lower which then caused me to relax a little even though the result was not good for these "adjusted" earnings. Here they should probably better have used earnings of continued operations instead of adjusted earnings.

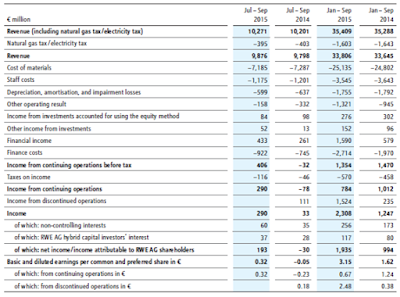

But let us take a look at the financial statement below. What we see is that the revenue, cost of materials, cost of staff and depreciation are all pretty flat for the running nine months but then we come to Other operating result and there we have around -400 million extra. This we do not like. What I like even less is that there is no footnote in direct connection to this 400 million difference and that annoys me. Digging a little there is a not that would explain around 159 million of it that stems from the value of old shares but the rest I could not find that easily. However the intangible assets have increased by around 400 million so either way... I do not like it.

The continuing operation earnings are down at 0.67 € per share compared to 1.24 € last year and this is of course bad news for us shareholders if we were expecting a nice solid dividend for the year and maybe even a recovery of the share price. There have been plenty of articles talking about that RWE will be forced to cut their dividends and now of late that they will need to split up the company just like E.On is doing. For me both matters are non issues, that said, I still like to collect my dividends but not enough to sell a company due to that they decrease or cut their payments,

Conclusion: RWE is doing so, so. I personally still find that they are doing better than E.On and yet they have been punished much harder than E.On during this year. But who knows what lurks in the shadows maybe they will also take an 11 billion € impairment cost. That would definitely make my day. I will remain as shareholder in RWE and I look forward to see how their cooperation concerning house/garden equipment that are controlled over the electrical system will continue to develop.

No comments:

Post a Comment