Due to the sale of two stocks (MüRe and K+S) I went on an investment bonanza during October. I therefore increased my holdings in RWE, Commerzbank, BP, E.On and K+S. I also started to completely new holdings namely Deere and fast Retailing. To be honest I feel a little investment saturated at the moment and I am considering to build up my 1k € buffer that I like to have on the broker account in case of special situations that can appear.

I privately also hold a 1k € buffer that is not on the broker account but are devoted to the same objective. That buffer I have managed to hold on to but the one on the broker account was eaten up during summer/autumn. I will look at my lists below and see what I decide to do. Who knows maybe there will even be a special situation appearing during this November which makes me clean out both buffers.

For the previous report please click on Stocks of Interest: October 2015.

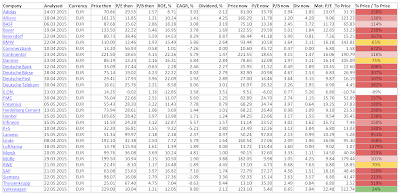

The top ten list contains this time: Balaton, Pharmstandard, Sollers, TransContainer, ARLP, Tag Immobilien, Encana, Volkswagen, Casino

and Splendid Medien. By the look of it Gilead have performed better and jumped out of the list. Volkswagen I am too scared to touch but well... I like Casino and have eyed them for some time.

My feeling is that I soon need to take the time to update all the companies with analysis that are still from 2014. Hopefully I will find the time for that now during November it will be a bit based on my studies and how time consuming that will be now with the new course.

My feeling is that I soon need to take the time to update all the companies with analysis that are still from 2014. Hopefully I will find the time for that now during November it will be a bit based on my studies and how time consuming that will be now with the new course.

Besides from that there is the error of Lanxess still in and not Vonovia which I need to analyse and add at some point we see that the car companies are still cheap as is RWE, MüRe, Continental and BASF. My only direct interest would be RWE and BASF at the moment.

Many, many cheap companies in my portfolio. The two banks as always and both of which at least I feel start to show some tendency to turn around. DBAG is cheap again and have insiders investing as of late. In Gerry Weber we have the same as for DBAG but I still see no customers in the stores so I cannot make further investments until I see that change. RWE is looking exciting and they have picked up the speed on green energy production at least according to releases from them. Volkswagen is of course also looking cheap but I do not dare to touch them yet.

Conclusion: There are indeed still interest investments out there and I will of course not stop my monthly investment routine but the choice is not that easy this time. I will therefore build up my broker account buffer and only make a small investment which means that it will be in a company that I already own. Which company do you think I should increase in?

6 comments:

You really are a good VW contra indicator! Just thinking about the stock makes it go down -10%

Hahaha!

Yeah, I will keep saying to everyone that they should never buy what I buy and when I buy it. If you like the company then just wait a little longer before buying it. It will be almost a guaranteed -30 to -50% compared to the price I paid for it!

The old rule says and I do believe it to be true... when there is "trouble" in a company than sell directly because there are usually many more skeletons hidden and once the entire world start digging those things will surface.

But for future reference I will stop thinking about VW or are there any more potential buyer out there that want to have it down a couple of more %-age points? :)

The funny thing is: a friend who is working at F&E Audi told me a few days ago that the two strong brands Audi & Porsche will get VW out of this messs. At least that was what the CEO said on a visit ;).

Anyway most People don´t even know that Porsche, Audi , Skoda, etc. belong to VW, so that only the main brand has Problems. But as it looks know you can assume that all of them are involved...

I think that before people did not know that Porsche, Audi, Skoda etc. did not belong to VW but now, due to all this, it becomes very clear since it is reported all over the news.

It is also counter productive for VW that have tried to keep their brands separated. This also shows that the separation obviously is bullshit since idiotic solutions to a problem has been treated similar within the entire organisation.

To my knowledge, I could be wrong though, the first response the CEO had to the new CO2 issues was to deny it. I wonder why...

Imho the CO2 is even a bigger problem. In austria the taxation on new cars is based on CO2 levels. Today I met alot of angry Audi drivers at work

In Sweden it is the same so... Yeah... 2 billion might be far from reality.

New rule to apply will be to directly sell companies when these kind of things appear with no exceptions.

-Fredrik von Oberhausen

Post a Comment