Business: This American company real estate company acquires, develops and manages its properties through

full-service regional offices. Its property portfolio is comprised

primarily of Class A office properties and also includes one hotel,

three residential properties and four retail properties.

Active: Only in the US and more specifically in five markets: Boston, New York, Princeton, San Francisco and Washington, DC.

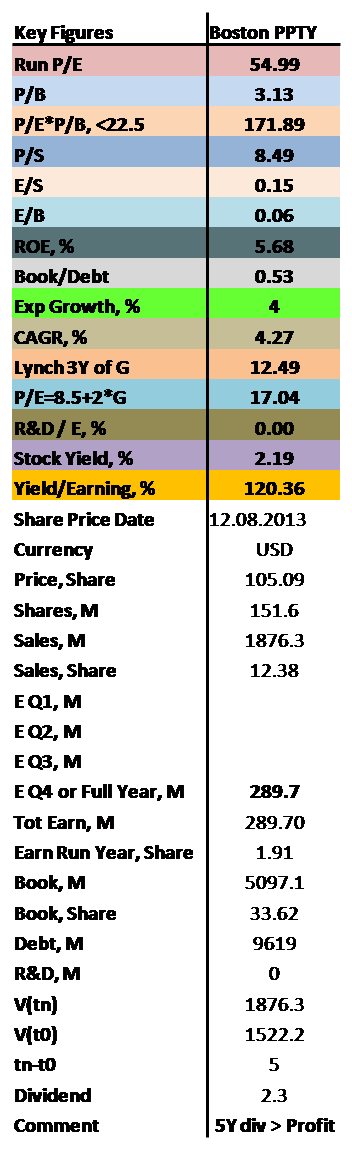

P/E: 55.0

As you can see I decided not to stay only in Germany and Europe. I find it very interesting that the entire industry seems to be very highly valued at the moment independent of country maybe even.

The P/E of Boston PPTY is insane high with 55.0 and the P/B is also far off any number of reason with 3.1. This of course leads to a very clear no go according to Graham. The earnings to sales is as high as 15% which I find pretty ok and the ROE is 5.7% which is bellow what it should have been. The book to debt seems to be pretty ok with a ratio of 0.5. The companies growth for the last 5 years has been an fully acceptable 4.3% which I really find ok for real estate. This leads to a motivated P/E of 15 to 17 so the market is seriously overvaluing the stock. They pay a dividend of 2.2% which is bad however that represents 120% of the earnings and what is even worse they have paid a dividend that has been higher than the profit for the last five years! Completely insane!

Conclusion: I would never buy this company at its current situation. The only future I see is a significant drop in value because the company is as overvalued as it can be. The question is... why have they been paying out so high much dividends for so long? I would seriously blame the management and the board for being reckless with the finances of the company.

If this analysis is outdated then

you can request a new one.

No comments:

Post a Comment