The Italian energy company, Enel S.p.A. came out with their half year report. Here is the points that they decided to be the most important ones:

Revenues: 40,157 million euros (40,692 million euros in 1H 2012, -1.3%)

EBITDA: 8,293 million euros (8,315 million euros in 1H 2012, -0.3%)

EBIT: 5,168 million euros (5,385 million euros in 1H 2012, -4.0%)

Group net income: 1,680 million euros (1,835 million euros in 1H 2012, -8.4%)

Group net ordinary income: 1,652 million euros (1,655 million euros in 1H 2012, -0.2%)

Net financial debt: 44,515 million euros (42,948 million euros as of December 31st, 2012, +3.6%)

What we can see above is that they have performed slightly worse this first half of 2013. The net income is in my eyes fully acceptable and I have no objections on that they are increasing their debt at the moment when credit is so easy and so cheap... as long as they will use it for expanding it will be fine. In their presentation they give an easier picture for why this was the case.

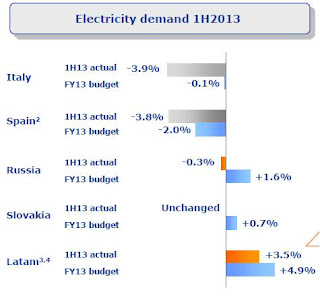

In the table above we see that Italy and Spain, which are the biggest markets for Enel have significantly decreased their electricity consumption. In Spain there are also some restrictions that mean that the price can not be set as Enel would like to. What I do not like with the table is that the budget is each time off in for me as a shareholder negative direction. The budget failure on italy i find the worst. It is their home market and where they have their head quarter so there I find 3.8% off, budget to actual, to be serious.

I also like that they are very strongly pushing wind power plants in the US and in South America.

Conclusion: 2013 is so far looking good for Enel. If they manage to keep it up then I expect to get a nice dividend next year which is why I became shareholder in the company. I will continue to keep my shares.

No comments:

Post a Comment