The hated, on the stock market, company K+S came out with their report which can be found here. Hated is probably a too strong word but the market is definitely scared of then insecurity which is at least in my opinion just plain silly which is why I bought the stock.

Here are the points that the CEO found of importance:

- Good sales volumes of Potash and Magnesium Products continue

- Salt business still significantly above last year

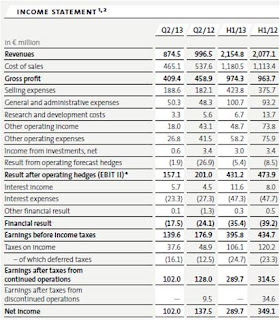

- Revenues of the first half year increase by 4% to € 2,154.8 million (H1/12: € 2,077.1 million)

- Operating earnings EBIT I reach € 440.5 million (H1/12: € 466.4 million)

- Adjusted earnings per share from continued operations at € 1.55 (H1/12: € 1.61)

- Legacy Project advanced according to plan

- Outlook: Due to the latest developments on the potash market and following the principle of prudence, we do no longer adhere to our outlook for the year 2013

Everything looks good besides from that they decided not to

adhere to the plan. My guess is that they are forced to say that due to

Uralkali statements but I doubt that K+S will be much influenced this year. It

is also good that Legacy is progressing as it should since K+S need the

increased volume of potash and magnesium to keep up with the world demand as

well as the competitors.

The second quarter was not so good but the half year still

looks good. This is mainly due to that they had very good sales of salt still

in the first quarter. When it comes to the potash and magnesium the sales did

decrease in the second quarter especially outside of Europe. I am looking

forward to see how strong effect it will become due to the complications with

Uralkali and if I will turn out to be correct or not.

Conclusion: I will of course keep my stock and I might even

try to increase it if the price remains low.

No comments:

Post a Comment